Tax is a mandatory financial surcharge or levy imposed on a taxable entity (an individual or legal body) by a government to fund government expenditures in delivering good governance to its people.

In Nigeria, the government organization in charge of enforcing and collecting tax is referred to as Inland Revenue Services.

Contents

Tax Laws / Legislations in Nigeria

Tax legislation is the act or process of enacting tax laws and the body of rules that provide for the levying of taxes and the administration of tax.

Nigeria has a compendium of tax laws guiding the administration of laws at all levels. Click here to download this compendium.

Taxes and all it embodies are usually not something most small business owners concern themselves with, and understandably so.

The requirements of running a business and keeping it thriving in Nigeria require a full complement of skills, of which taxation is a key but usually a neglected part.

Since the President signed the Finance Act 2019 into law, there has been a raft of changes across the taxation sector, and these changes also apply to small businesses.

It would be suicidal not to be aware of these changes, which is why we have written this guide for you.

Let’s dive in.

Tax Identification Number (TIN)

The new Nigeria Finance bill (2019) made amendments to the Personal Income Tax Act, specifically in sections 33, 49, and 58. These amendments led to the mandatory design of the Tax Identification Number.

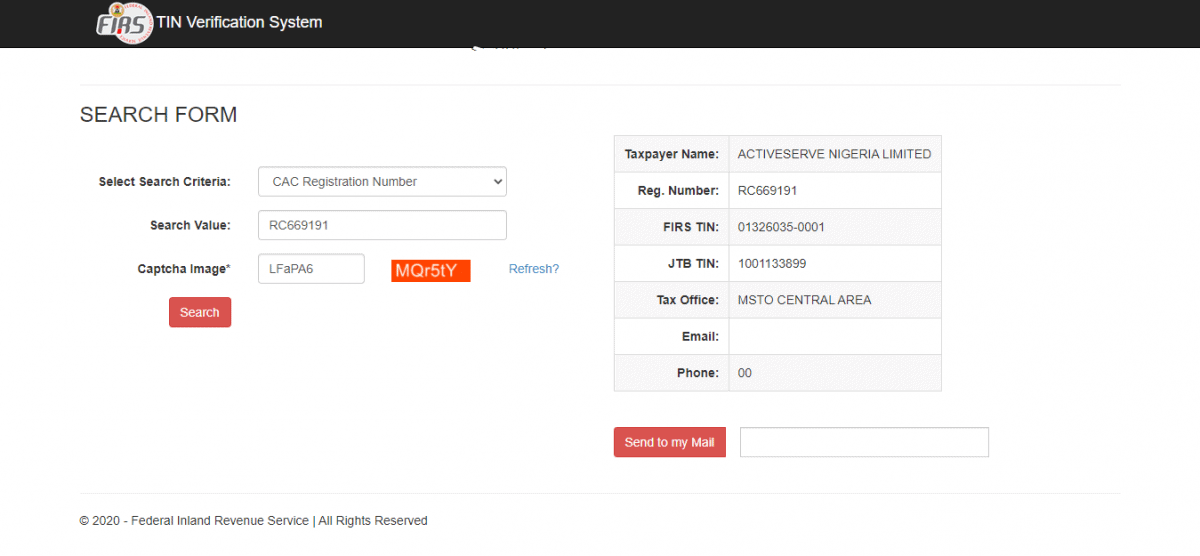

The TIN is now a compulsory requirement for every taxable entity (entity here means both individuals of taxable age and companies). It is a uniquely generated 14 digit number that identifies a taxable entity for payment of taxes due.

Application for and the issuing of your TIN is free, so ensure you are not conned into paying for it.

Click here to search for your TIN – Freely!

Why Should You Get a TIN

Getting a TIN in Nigeria is now mandatory, so that’s a good reason to get yours. But beyond that, the following are the reasons why you should get your TIN, especially as a small business owner.

- Access to Government Loans

- Foreign Exchange

- Vehicle Registration

- Application for Certificate of Occupancy

- Tax Clearance for Business

- Access to a Bank Account

- Application for an import license and an export license

- Many more reasons abound

- Access To Government Loans, Grants and Other Social Safety Net Initiatives: The government has tied access to any government loan, either federal or state, to the acquisition of your TIN. It would be a shame to be denied a chance to get much-needed funds from a government loan because you don’t have your TIN.

- Foreign Exchange: TIN is now a compulsory requirement to access foreign exchange at any registered BDC in Nigeria.

- Vehicle Registration: Without a TIN, you won’t be able to register a vehicle, be it a car, a tricycle, or a motorcycle. Using an unregistered vehicle puts you in the uncomfortable position of being accused of stealing the vehicle. Apart from that, if you run a business in which a vehicle is an asset, you’d need to register it, and not having your TIN would be a barrier to that.

- Application for Certificate of Occupancy: This also reinforces the need to get your TIN. Not being able to apply for a C of O means you won’t be able to take lawful possession of any property you buy, which will most likely be a problem.

- Tax Clearance for Business: This is quite straightforward, as not having a TIN automatically rules out the chances of you being able to pay tax. And if you can’t pay tax, how can you get a tax clearance? Not having a tax clearance certificate as a business owner limits your chances of effectively conducting your business in Nigeria.

- Access to a Bank Account: Either as a business or as an individual, failure to get your TIN will mean you won’t be able to open a new bank account, neither will you be able to maintain the one(s) you have. This denial of access to essential banking services hammers home the point of how important it is to get your TIN as soon as possible.

- Application for an import license and an export license: If you need to import or export goods or services in and out of Nigeria, a onetime license registration procedure must be completed. Such import/export license may be obtained from concerned government department of Nigeria.

For importing to Nigeria, you must do the following amongst others,

a) Should register the company or business name in Nigeria with the Corporate Affairs Commission (CAC).

b) Register the company with the Federal Inland Revenue Services (FIRS) and get Tax Identification Number (TIN Number) as the proof of tax payments.

How To Get Your TIN in Nigeria.

With the utmost importance of getting your Tax Identification Number highlighted above, knowing how to get your TIN is imperative. The following steps will explain how:

- As an Individual: Getting your TIN as an individual is a seamless and easy process. This is because the generation of your TIN is based upon your possession of either your Bank Verification Number or your National Identity Number. Having both of them, or at worst, one of them guarantees you a TIN. All you then need is to verify yours.

- As a Registered Business Name: If your business is not yet incorporated, but it already has a registered business name, then getting your TIN isn’t any trouble. All you have to do is to apply for your VAT number, and once you get it, it will also be your TIN number.

- As an Incorporated Business: To get your TIN as an already incorporated business, go to any FIRS office that’s close to your registered address. You can find the address of the FIRS offices on their website. Ensure you take the following documents along with you;

- Write an application letter on a company letter headed paper.

- Fill a TIN application form

- The Articles and Memorandum of Association of the company

- The company seal

- A copy of a utility bill

- The Certificate of Incorporation

You should present all documents listed above in triplicates to the FIRS to get your TIN issued; one original copy and two photocopies. Ensure you leave one photocopy with the FIRS officials, and get the other stamped by a FIRS official.

Note: The issuance of TIN is now automated for new registrations at the CAC, and issued on the incorporation of a new business entity – business name or company.

Taxes in Nigeria

Categories of Taxes in Nigeria:

At the federal level, we have the FIRS – Federal Inland Revenue Services, and at the state level, we have the State Inland Revenue Services, with examples such as the LIRS, EIRS, etc.

Federal taxes include Companies Income Tax, Value Added Tax, Education Tax, etc.

State taxes, on the other hand, include Personal Income Tax, Business Premises Tax, Development levy, etc.

Personal Income Tax

Personal Income Tax is another tax that a small business owner must be aware of. The Personal Income Tax Act of Nigeria prescribes the conditions in which personal income tax is payable. It also prescribes the terms of collections and the identity of the tax collector. The state government is the usual collector of personal income tax (PIT).

Personal income tax is a direct tax that is usually charged on the income of an individual or a business entity that has an annual turnover of less than N25,000,000.

Personal Income Tax Rates

The Personal Income Tax Rate in Nigeria stands at a minimum of 7% and a maximum of 24 percent depending on a person’s taxable income level.

| Annual Taxable Revenue | Rate |

|---|---|

| First N300,000 | 7% |

| Next N300,000 | 11% |

| Next N500,000 | 15% |

| Next N500,000 | 19% |

| Next N1,600,000 | 21% |

| Over N3,200,000 | 24% |

Conditions For the Payment of Personal Income Tax

Personal income tax is only payable by people who gain or profit from being either self-employed or being salaried is derived from Nigeria. This means that the operations of employment are performed in Nigeria, either wholly or partly.

Place of Residence and Its Importance to Assessment and Collection of Personal Income Tax

Under the provision of the PIT Act (as amended), the place of residence of a taxpayer is a place where they use for domestic purposes for each day. This rules out hotels and guesthouses.

A place of residence, or a principal place of residence, if the taxpayer has more than one, needs to be determined. This is because a place of residence will determine the relevant tax authority.

The relevant tax authority is the State Internal Revenue Service in which the taxpayer has a principal place of residence.

For instance, if a taxpayer lives in Ibadan, but works in Abeokuta, then the taxpayer will remit taxes to the Oyo State Internal Revenue Service.

Calculating your taxes has not been easier. Today, with the clicks of a few buttons on your keyboard, you could easily calculate your Personal Income Tax as well as other tax, using the FIRST Tax calculator.

Withholding Tax

Withholding tax (WHT) is another area in taxation that many Nigerians claim is stressful. But is it? Sometimes, it is, especially when you don’t understand how it works.

How Does WHT Work?

Withholding tax is a form of indirect taxation. It is done in advance from the very source at which you make supplies.

To make it more straightforward, here’s a simpler explanation. Assume you make a supply of beverages to another business, and it totals 500,000 Naira.

At the point of delivery, you will write an invoice for your buyer, showing the amount they are to pay. From the #500,000, your buyer is expected to give you only #450,000, assuming that the supply’s WHT is 10%. The #50,000 that has been deducted by your buyer is to be remitted to the relevant tax authority, which is usually the Federal Internal Revenue System or the State Internal Revenue System.

The evidence of remittance must then be handed over to you as the supplier so that you can present it to tax officers when they visit you or when filing your annual taxes.

Employers are also expected to ‘withhold’ this tax on wages, bonuses, and so on. Pensions, winnings at a gamble, and payment on residential properties are also eligible for withholding tax.

The only exemptions provided by the law are on transactions that don’t involve a contract of purchase, that is, transactions that don’t involve supply. 13th-month pay and self-employed members of the society are also exempted.

Withholding tax is not deductible on everyday purchases.

Withholding Tax Rates in 2020

The current rates on withholding tax depends on the type of transaction involved. Different transactions attract higher or lower rates.

It also depends on the tax authority involved, whether it’s the Federal Internal Revenue System or the State Internal Revenue System. Currently, withholding tax ranges from 5% to 10%.

Advantages of Withholding Tax

Most of the merits of withholding tax come back to you as the supplier.

- It’s more like advance payment.

Withholding tax is taken before you’re paid for your supply, so it makes it easier to comply with the law. Seeing how burdensome taxes may be for small businesses, it’s an excellent way to do what you have to do.

- It reduces your tax by the end of the financial year.

By the end of the financial year, you’ll have less to pay in taxes having paid your withholding tax as the year went by. All you have to do is ensure that you keep your credit note so that you don’t get charged extra.

- It helps the government to curb tax evasion.

This merit is for the government. Withholding tax has primarily helped the government to reduce how often people evade paying taxes.

Withholding Tax Credit Notes

It is a document that serves as the evidence of payment of the withholding tax after a supply transaction. The tax authority is in charge of issuing the credit note to the person who purchased goods from you. You will have to return to your purchaser to obtain the document as you will need it in the future.

The credit note includes essential details such as the credit number, date of transaction, purchaser’s name, beneficiary (supplier’s) name, and the nature of the transaction.

Penalties for Not Paying Withholding Tax

Generally, it’s better not to get caught detailing as the consequences can be severe, especially for small businesses.

It attracts 200% per annum for companies that default and #5000 per annum for individuals.

Problems of Withholding Tax in Nigeria

For small businesses, withholding tax can get problematic in the following ways;

- Inefficiency in Issuing the Withholding Tax Credit Note by Relevant Authorities: In places where the credit note issuance is not automated, it is a complicated process trying to obtain it. There’s unnecessary and burdensome paperwork involved sometimes, and this can cause problems for small businesses in the country.

- Rigorous Refund Process: If there’s a mistake and you overpay to the government, it is nearly impossible to receive a refund. That is not good enough, and such process issues have made withholding tax a rather unattractive topic for many entrepreneurs.

- Lack of Clarity in Defining Rates: The withholding tax rates on certain goods and services in the country are not clearly defined. Since the 5% to 10% rate depends on the kind of transaction carried out, there should be a clear definition of what transactions attract particular rates.

VAT

Value Added Tax (VAT) is simply consumer tax. It’s a kind of tax imposed on goods and services, and unlike withholding tax, the burden of VAT is on the final consumer.

Though VAT is charged at every stage of the supply chain, it does not mean that the final consumer will pay more than expected. Importers, suppliers, manufacturers, and distributors are mandated to register by obtaining a VAT registration number.

Goods that Attract VAT

Certain goods and services are VATable while some are not.

All goods imported to Nigeria (with some exceptions) are charged with VAT. The payment of VAT does not take away the fact that custom duties and other charges must be paid.

The exemptions are:

- Exported goods

- Educational materials like books

- Agricultural equipment

- Medical services

- Basic food items

- Newspapers

- Veterinary Medicine equipment

- Commercial vehicles

- Baby products

- Bank services, especially community, People, and mortgage banks.

- Zero-rated items are not charged for VAT.

How is VAT Calculated and Paid

Currently, in Nigeria, VAT is 7.5% of the invoice value.

Your output VAT is collected on your sales of VATable goods and services to ordinary customers as well as other businesses.

Your input VAT is the VAT that you pay as a buyer in the goods and services you purchase. You can legally claim this as a credit when paying VAT to the FIRS. This will reduce the amount you’ll pay altogether.

To claim your input VAT as credit, you must tender your tax invoice. Tax invoices are issued with supply and they show the VAT information for the supplies made to you.

How Long Does it Take To Process TIN?

Allowing for backlogs and slow responses due to the Covid-19 pandemic, it shouldn’t be more than two weeks.

Is Tax Avoidance Illegal?

Tax avoidance is not illegal. Many small businesses do it to save as much money as possible to finance the growth of their businesses.

It is only illegal when you cross over into tax evasion by hiding your actual income or claiming expenses that are not true. You can also get into trouble when you dishonestly declare bankruptcy.

What is Direct tax

Direct tax is taxes, such as income tax, which is levied on the income or profits of the person who pays it, rather than on goods or services. It is not transferred to the final beneficiary of the taxable product or services

Recommended: 8 Ways To Build an Effective Startup Team that will last

Tax Avoidance

Tax avoidance is the use of legal methods to minimize the amount of income tax that an entity – an individual or a business should pay. This is generally accomplished by claiming as many deductions and credits as are allowable. It may also be achieved by prioritizing investments that have tax advantages, such as buying government bonds.

In Nigeria, there are loopholes in the taxation system that you can plug into to give you a breathing space on how much taxes you have to remit to the government per time. Exploiting these loopholes is called Tax Avoidance.

As a small business, you should have quality education on tax laws so that you will avoid paying excessively to the government each time. You’ll also get more funds to grow your business. The traps to be aware of, though, is that you must not cross the thin line into tax evasion. It’s like a criminal threshold that you mustn’t break because if you do, you can get into more trouble than you bargained for.

Many knowledgeable individuals and business owners engage in legal tax avoidance activities. Such practices exists in Nigeria and It is only fair that you’re aware of it too.

How to Activate Tax Avoidance

It’s important to note that you should do this only with the help of a tax expert. That way, you’re sure of success without getting in the way of the law. To reduce the tax liability in your business, here are a few methods that you can use;

- Invest in Certain Sectors: There are sectors that the Nigerian government wants the citizens to invest in. To encourage this, they offer incentives such as freedom from tax payment for a period to the investors. These government promoted organizations, including the pioneer industries, can exempt you from paying tax for up to five years. There are also sectors such as Agriculture (no VAT on products) where fewer tax payments are incorporated to attract investors. You can take advantage of this.

- Invest Proceeds from Capital Gains into Buying Capital Gains: This method is quite direct. It’s commonly used when you sell an asset in your business. All you have to do is put back your proceeds into buying another asset that is in the same class as the one you just sold. For example, if you sold your delivery truck for 3 million naira, by investing that amount back into getting another truck, you can successfully avoid paying tax on the money you made from selling the delivery truck.

- Donate to NGOs: Sending donations to non-governmental organizations is rewarded by exempting you from paying tax on the part of your income that you donated. Since you’re giving to a charitable cause, it’s seen as a support of public efforts to make the country a better place. Note that you can only donate to NGOs that are stated in the Schedule 5 CIITA. Examples are the Boys Brigade, Girls Guide, and Red Cross. You can find out the rest of them by consulting a tax expert.

- Depending on Your Business Type, You May Have an Advantage: Depending on the type of business you run, you may have several advantages that you can grab. For real estate companies, for example, the homes and lands are seen as inventory. That is in compliance with the Nigerian Standard Board. You can avoid capital gains tax by going through the right means.

- Keep Records of Past Losses in Your Business: If your business is in debt, you should record it. If you recently hit a loss and have to pay it from a profit you just made, state it clearly. For example, if your most recent profit is 5 million naira, and you have to rectify a loss of 3.5 million naira, what you’ll be taxed on is 1.5 million naira. Losses are not meant to be taxed.

- Register as a Non-profit Organization: Of course, this is another way out. To avoid taxes totally, you can register your business as a non-profit. Although, if you make any investments in other sectors, you will be taxed. Another side to it is that you as the owner will not be eligible to receive dividends from the company.

There are in fact many other ways to avoid paying taxes, and you can know them all by talking to a tax expert.

CONCLUSION

The world of taxation is a complex and mystifying one, which is why we have written this guide to help sort tax issues out, especially as it concerns you as a business owner in Nigeria.

NEED A TRUSTED TAX CONSULTANT TO HELP YOU ACHIEVE TAX COMPLIANCE?

LOOKING TO TAKE ADVANTAGE OF SOME OF THE TAX HOLIDAYS, AND EXEMPTIONS WITHIN THE NIGERIAN TAX SYSTEM?

Having a tax expert to go along with the information you’ve just gotten will help ensure that you are on top of tax matters in your business. If you’d like to hire a tax expert, we greatly recommend Microflex limited.

Microflex limited is a sterling business development services expert with focus on developing MSMEs in Nigeria. She is committed to helping businesses of all sizes across several industries achieve their business development goals and tax compliance.

Contact Microflex limited and take full advantage of all the tax holidays and exemptions.

Contact: Info@microflex.com.ng or dial 07051114444 for a free consultation.