Estimated reading time: 11 minutes

Most often we get to that point where we need extra push to get a business moving, or just need that extra money to keep us afloat until that break through comes. At some of those times, getting such quick loans from friends aren’t all that what we may want to consider – At such instances, we loathe the ideas of walking into a bank.

Luckily, we have some apps and online platforms in Nigeria that would be willing to give out such cash breaks without so much of a collateral that would demand for your head.

Attached is a video that I recommend; it has most of the tips that you need to know before you go for any of these apps.

In no particular order, listed below is a list of some of the best loan apps in Nigeria that can help you with that fast loan without collateral. All you have to do to get a loan is to get a smartphone, some data/network access, download any of the listed apps anytime.

No Paperwork needed, No Guarantor. No Collateral; and it is 24/7 Available.

- Branch – https://branc.co

- Carbon – https://ng.getarbon.co

- Palmcredit – NEWEDGE (newedgefinance.com)

- Okash – Home (o-kash.com)

- Fairmoney – FairMoney Loan App

- Aella Credit – Quick and easy financial services (aellaapp.com)

- Blackcopper – Blackcopper

There, you have it, the list of the best loan apps in Nigeria.

They have something in common, which is the fact that they are all money lending apps. However, they are slightly different from each other in terms of interest rate, amount offered, speed of delivery, mode of payment and target market (individuals, businesses or both).

Almost everyone has had those moments when they needed a money lending app to settle a personal or business need – You needed a fast cash.

No one wants to go through that stress of filling papers upon papers and having to look for collaterals to get loans from banks. Not in this era of instant gratification.

Thanks to the recent boom in the Nigerian Fintech industry, there is a rise in the number of apps that borrow money in the country. That means individuals and business owners can now access quick loans for personal use and business development.

So, it’s good news for everyone as there are now several money lending apps that you can download and get a loan from within minutes.

No collateral. No paperwork. No stress. All from the comfort of your home. And very reasonable interest rate.

Contents

Table of contents

Must Read: Preparing for the New Year: A Guide for Business Owners

Branch

Arguably the most popular of the lot, Branch is an easy to use app to borrow money in Nigeria. Are you thinking of getting “money at the speed of life”? This is what Branch represents.

The loan app says they are committed to “building a new frontier of finance — where banks aren’t physical, paperwork is obsolete, and possibility is the end game.”

From application to loan dispensation, the entire process of getting a loan from Branch money lending app starts and ends on the Branch mobile app.

While Branch doesn’t require any form of collateral to process your application, they look out for the following:

- Your handset details

- Repayment history

- GPS data

- Contact lists

- SMS logs

The above are measures the loan app put in place to enable you to pay back loans taken.

How to get a loan from Branch app

The process of getting a loan from Branch is relatively easy and straight to the point.

- Download the Branch app from the Google play store

- Create your account by filling a form in less than 30 seconds and submit for a review

- Apply for the loan that would solve your need and which you can conveniently payback, and have it delivered to your bank account within minutes

- Payback your loan on time to unlock larger loan amounts in subsequent applications

Interest Rate: 15% – 34%

Loan amounts: ₦1,000 – ₦200,000

Loan terms: 4 – 40weeks

Target market: Individuals and businesses

Must Read: How to Start an Online Business

Carbon (Paylater)

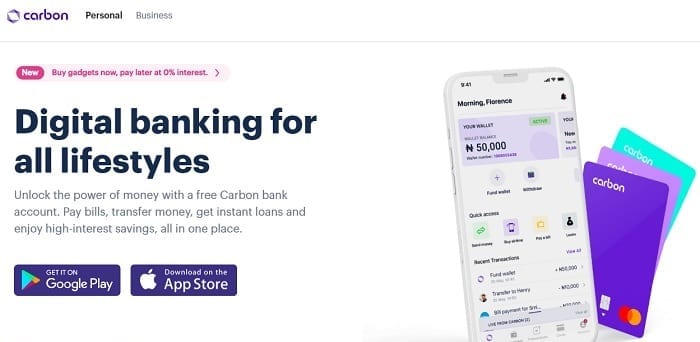

Formerly known as Paylater, Carbon is a digital banking app that also gives out loan to individuals and businesses. The app provides all sorts of exciting financial services, including savings, investment, payments and so on.

Hence, Carbon is more than an app for borrowing money; it is an app that offers “digital banking for all lifestyles”. However, for this post, let’s focus on its loan feature.

Insured by NDIC and certified by the Central Bank of Nigeria (CBN), Carbon loan does not require any form of collateral, neither would you have to fill any form. The entire process is online, and you will receive your loan within minutes.

How to get a loan from Carbon app

- Download the Carbon app from the iOS app store or Google Play store

- Register in few minutes by providing a few details about yourself

- Go ahead and apply for loans

- Your loan would be sent to your wallet on the app from where you can use it for different transactions. You can also send the money from your wallet to your bank account so you can withdraw it.

- Payback your loan on time to unlock higher amounts. Also, you stand a chance of getting 10 – 100% cashback when you pay back your loan on time.

Interest Rate: 1.75% – 30%

Loan amounts: ₦1,500 – ₦1,000,000

Loan terms: Up to 64 weeks

Target market: Individuals and businesses

Must Read: 7 Financial Tools for Small Business Owners

PalmCredit

PalmCredit is another mobile app that gives Nigerians easy and convenient loan. Boasting of being “Nigeria No. 1 online loan…”, the money lending app offers flexible loans with reasonable interest rates.

As with most other loan apps, paying back your loan on time on PalmCredit helps you to update your credit score. The implication of that is you get higher offers when next you apply for a loan.

Some of its unique fixtures include offering up to 100k loan with a daily interest rate of 1.2%.

How to get a loan from PalmCredit

- Download the Palmcredit mobile app from your app store

- Register and set your account in minutes

- Apply for a loan

- Get approval within minutes

- The loan is disbursed to your bank account

Interest Rate: 14% – 24%

Loan amounts: ₦2,000 – ₦100,000

Loan terms: 14 – 180 days

Target market: Individuals

Okash

A product of OPay, Okash is another loan app that offers loans to Nigerians. The app is committed to increasing access to loan facilities to the underserved section of the society.

You get loan decisions on Okash within seconds, and once your loan is approved, you’d receive funds within 5 minutes.

For your first loan application on Okash, you can’t get more than ₦10,000. The money will increase in subsequent applications, especially if you pay back your loan on time.

Okash loans are provided in partnership with Blue Ridge Microfinance bank; hence you can pay back your loan via direct transfer to Blue Ridge Microfinance bank account (Zenith Bank Account No:1130085518)

How to get loan from Okash

- Download and install the Okash app from your app store

- Register an account

- Select the product or loan amount you’d like to apply for

- Provide necessary information and submit your application

- You may get a call for verification after submitting your application. Ensure you provide the right information

- E-sign the loan agreement after approval

- After this, the approved loan will be dispensed to your registered bank account

Interest Rate: 23 – 35%

Loan amounts: ₦3,000 – ₦500,000

Loan terms: 7 days – 365 days

Target market: Individuals and businesses

Fairmoney

Fairmoney is a money lending app for Nigerians where you can get a loan within 5 minutes. You know this is a big deal if you’ve had to wait for days to get a loan from your bank.

Fairmoney is not just a loan app, by the way. The app also provides some essential financial solutions such as airtime recharge and payment of bills.

The primary requirement for a Fairmoney loan is your BVN, and you can get as much as N500,000. And you can spread repayments in multiple instalments for ease and flexibility.

How to get a loan from Fairmoney

- Download the Fairmoney app from the Playstore

- Signup with your phone number and create your PIN

- Click apply on the home page

- Answer the few questions provided

- Get a loan offer

- Choose amount and tenor

- Accept the loan offer

- Provide bank details where you want your money sent and get it within minutes

Interest Rate: 10 – 30%

Loan amounts: ₦1,500 – ₦500,000

Loan terms: 61 – 180 days

Target market: Individuals and businesses

Aella Credit

Aella Credit is a fintech app that provides such services as payments, investment, and loans. The app makes it “super easy for anyone to borrow, invest and make payments” without excuses.

The money lending app even offers affordable insurance services for its customers. Now, that’s something different compared to others in the list.

For Aella, the end goal is to provide financial inclusion for all, irrespective of social class or profession.

How to get a loan from Aella Credit

- Download the Aella app from your app store

- Create your account by filling out your details in less than a minute

- Answer some quick questions to update your profile

- Click the “check eligibility” button to see if you qualify for a loan and how much

- Apply for the loan, and it will be sent to your provided bank account within minutes

- Payback your loan on time

Interest Rate: 4 – 20%

Loan amounts: ₦2,000 – ₦1,000,000

Loan terms: 1 – 3 months

Target market: Individuals and businesses

Blackcopper

If you are thinking of an app where you can borrow money to grow your business, then checkout Blackcopper. The app is committed to keeping “the wheels turning for your business”.

Aside from giving quick loans to individuals and businesses, Blackcopper also has investment opportunities for its users. Sign up to benefit from either of the two services the app offers.

How to get a loan from Blackcopper

- Download the Blackcopper mobile app from Apple store or Google Play store

- Register your account by providing the required information. Secure your account by verifying it via mail

- Access Quick loans for your business needs or access investment opportunities on the app

Interest Rate: As low as 3.74%

Loan amounts: ₦500,000

Loan terms: Up to 6 months

Target market: Individuals and Businesses

FAQ

1. You must bee between the ages of 22 – 59 years old2

2. Have a verifiable source of income

3. Live and/or work in cities where we operate

4. Have a savings or current bank account with any commercial bank

You need your bank statement, a government issued ID card and utility bill (optional).

Branch offers loans from ₦1,000 to ₦200,000. Loan terms range from 4 – 40 weeks. Interest ranges from 15% – 34% with an equivalent monthly interest of 3% – 21% and APR of 33% – 261%, depending on your loan option.

Conclusion

Accessing loans for personal needs and business development is no longer so much of an issue. However, resist the urge to get a loan when you don’t need one or don’t have a clear plan to pay back.

Also, take your time to study these money lending apps’ terms and conditions before submitting your application for loans. Be sure you agree with these terms to prevent future regrets, especially in terms of the interest rate.

Do you know of other loan apps with amazing offers and excellent services? Share in the comments.

Suggested Readings:

It is in point of fact a nice and useful piece

of information. I’m satisfied that you shared this helpful information with us.

Please stay us up to date like this. Thank you for sharing.

Undeniably believe that which you stated. Your favorite justification seemed

to be on the net the easiest thing to be aware of.

I say to you, I certainly get annoyed while people

consider worries that they just do not know about.

You managed to hit the nail upon the top and defined out the whole thing without having side-effects , people could take a signal.

Will probably be back to get more. Thanks

Wonderful blog! I found it while searching on Yahoo News.

Do you have any tips on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Thank you

If some one desires expert view about blogging and site-building afterward i propose him/her to pay a quick visit this website,

Keep up the nice job.

Hurrah, that’s what I was looking for, what a information!

present here at this webpage, thanks admin of this site.

My partner and I stumbled over here by a different page and thought

I should check things out. I like what I see so now i am following you.

Look forward to checking out your web page repeatedly.

Also visit my page; Slot Mpojaya

I’m extremely impressed with your writing skills as well

as with the layout on your weblog. Is this a paid theme or did you modify it yourself?

Either way keep up the nice quality writing, it is rare to see a nice blog like this one these days.

Write more, thats all I have to say. Literally, it seems

as though you relied on the video to make your point.

You obviously know what youre talking about,

why waste your intelligence on just posting videos to your site when you

could be giving us something enlightening to read?

I’m not sure where you’re getting your info, but good topic.

I needs to spend some time learning more or understanding more.

Thanks for great info I was looking for this information for my mission.

Perhaps, someday, I’ll show you the bloopers.

Write more, thats all I have to say. Literally, it seems as though you

relied on the video to make your point. You obviously know what youre talking

about, why throw away your intelligence on just posting videos to your site when you

could be giving us something informative to read?

When you find web blogs and web sites that contain information on accounting, you can do three things.

Чтобы скачать прибавление 1xslots с официального сайта, сделайте следующие шаги:

Перейдите на официальный сайт 1xslots. Введите адресок сайта в браузере вашего прибора.

Найдите раздел для скачивания прибавления. Обычно на ключевой страничке или в меню есть гиперссылка на скачивание прибавления для Android.

Скачайте APK-файл. Нажмите на ссылку для загрузки, и файл начнет загружаться на ваше устройство.

Разрешите установку из неведомых источников https://1xslotszerkala.ru/mobilnaya-versiya/. Если у вас еще не включена установка приложений из безызвестных источников, перейдите в опции вашего прибора, позже в раздел “Безопасность” и активируйте эту опцию.

Установите прибавленье. Найдите загруженный APK-файл в файловом менеджере и нажмите на него, чтобы начать установку.

После окончания установки появится открыть прибавление и войти в собственный акк или же зарегистрироваться, случае у вас его ещё нет.

Kudos! Excellent stuff!

Artikel ini bikin makin yakin buat main di Hokagetogel.

Saya udah coba sendiri dan hasilnya nggak mengecewakan. Nggak salah kalau Hokagetogel

jadi favorit pemain slot online.

I know this if off topic but I’m looking into starting my own blog and was

wondering what all is required to get set up?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet savvy so I’m not 100% certain.

Any recommendations or advice would be greatly

appreciated. Kudos

I know this if off topic but I’m looking into starting my own blog and was curious what all

is needed to get set up? I’m assuming having a blog like

yours would cost a pretty penny? I’m not very web smart so I’m

not 100% sure. Any recommendations or advice would be greatly appreciated.

Thanks

Great beat ! I would like to apprentice even as you amend your web site,

how could i subscribe for a blog website? The account helped me

a acceptable deal. I had been tiny bit familiar of this your broadcast offered vibrant clear

concept

Hi, I wish for to subscribe for this webpage to get newest updates, thus where can i do it please assist.

You said it nicely..

Also visit my website – http://naraefood.co/g5/bbs/board.php?bo_table=free&wr_id=19901

What’s up all, here every person is sharing these kinds of familiarity, therefore it’s pleasant

to read this web site, and I used to pay a quick visit this webpage everyday.

Financial advisors may show you how to manage your investments and plan for long-time period goals.

With out sturdy content, Search engine marketing ideas and tricks will provide a short lived increase in your site’s rating at finest.

Hey there I am so grateful I found your web site, I really

found you by error, while I was researching on Digg for something else, Nonetheless I

am here now and would just like to say thanks for a incredible post and a all round exciting blog (I

also love the theme/design), I don’t have time to read through it all at the minute but I have book-marked

it and also added in your RSS feeds, so when I have time I will

be back to read a great deal more, Please do keep

up the superb work.

Hello, its fastidious piece of writing on the topic of media print,

we all understand media is a fantastic source of data.

I do not even know how I ended up here, but I thought this post

was good. I don’t know who you are but certainly you

are going to a famous blogger if you are not already 😉 Cheers!

If you are going for best contents like me, simply go to see this site everyday for the reason that

it presents feature contents, thanks

Generally I do not read article on blogs, however I would like to say

that this write-up very compelled me to check out and do so!

Your writing taste has been surprised me. Thanks, very nice article.

Seriously lots of awesome facts.

Very good article. I will be experiencing some of

these issues as well..

Artikel ini sangat informatif! Saya setuju banget kalau Direksitoto adalah pilihan terbaik.

Fitur slot live dan deposit Dana-nya sangat membantu. Rekomendasi banget buat yang cari situs gacor

I blog often and I really thank you for your content.

This article has truly peaked my interest. I

will book mark your blog and keep checking for new details

about once a week. I opted in for your RSS feed too.

Hi! I simply would like to offer you a huge thumbs up for the great info you have here on this post.

I’ll be returning to your blog for more soon.

I’m gone to tell my little brother, that he should also go to see this website on regular basis to get updated from most recent information.

Woah! I’m really enjoying the template/theme of this site.

It’s simple, yet effective. A lot of times it’s challenging to get

that “perfect balance” between usability and visual appearance.

I must say you have done a awesome job with this. In addition, the blog loads extremely quick for me on Internet

explorer. Outstanding Blog!

Appreciate the recommendation. Will try it out.

Stop by my web-site: link MPOBIG

If some one wishes to be updated with most recent technologies then he must be go to see this site and be

up to date daily.

The Treasurer was responsible for the security of the King’s treasury.

It’s largely about vocabulary gathering at the moment.

Nicely put, With thanks.

https://digi343sa.netlify.app/research/digi343sa-(13)

The high-end retailer sells loads of coveted luxurious brands like Monique Lhuillier, THEIA, Jenny Packham, Badgley Mischka and extra.

Superb website you have here but I was curious about if you knew of any community forums that cover the same

topics discussed here? I’d really love to be a part of group

where I can get feedback from other experienced individuals that share the same interest.

If you have any recommendations, please let me know.

Thank you!

It’s difficult to find experienced people for this topic, but you seem

like you know what you’re talking about!

Thanks

This is a topic that’s near to my heart… Take care!

Where are your contact details though?

It’s nearly impossible to find experienced people in this particular topic, however,

you seem like you know what you’re talking about! Thanks

Thanks for every other fantastic post. Where else may anyone get that type of information in such a perfect way

of writing? I’ve a presentation subsequent week, and I’m on the look for such

info.

You need to be a part of a contest for one of the most useful

websites on the internet. I am going to recommend this site!

Thank you for every other wonderful article. The place else may just

anyone get that type of information in such an ideal approach

of writing? I’ve a presentation subsequent week, and I am on the look for such info.

Have you ever thought about publishing an e-book or guest authoring on other sites?

I have a blog based upon on the same topics you discuss and would

really like to have you share some stories/information. I know my viewers would enjoy your work.

If you’re even remotely interested, feel free to send

me an email.

This piece of writing will help the internet people for building up new weblog or even a

blog from start to end.

Even though the raw meat was contaminated, cooking it to a excessive enough temperature (155 degrees Fahrenheit or 68.3 degrees Celsius) would have killed the E. coli and made it safe to eat.

Councils that use many baggage and packing containers (Edinburgh) endure from much less contamination however are difficult and the loose paper and cardboard, and plastic recycling bags are blown round by the wind, and paper can change into wet due to rain or snow, or contaminated with meals residue, dirt, oil or grease.

Some really wonderful info, Gladiolus I discovered this.

my web blog; https://Gamereleasetoday.com/2-in-order-to-make-money-via-internet-3/

Wai Ko Lo is the stage identify of actor Ken Lo.

Sactosalpinx is a gynecological illness characterized by means of the aggregation of

fluid in the lumen of the fallopian tube, paramount to a contravention of its patency.

It is as a rule diagnosed in patients below 30 years of age and continually

acts as a call of infertility. As a consequence, according to statistics,

sactosalpinx is initiate in 7-28% of women who cannot clear pregnant.

The pathology all but always occurs as a intricacy of another gynecological malady,

especially of an catching and explosive nature.

What to Look For In Bankruptcy Software With todays technology, different legal software is available to help both lawyers and non-lawyers accomplish necessary legal paper work. When it comes to bankruptcy filing, bankruptcy software allows [read more..]

We’re a gaggle of volunteers and starting a brand new scheme in our community.

Your web site provided us with helpful info to work on. You have done an impressive job and our

entire group will be grateful to you.

I got this web page from my buddy who told me regarding this

web site and at the moment this time I am browsing

this web page and reading very informative articles or reviews at this place.

Having read this I thought it was extremely enlightening.

I appreciate you finding the time and energy to put this information together.

I once again find myself spending a significant amount of time

both reading and leaving comments. But so what, it was still worth it!

Aw, this was an extremely good post. Taking the time and actual effort to create a great article… but what can I say… I procrastinate a whole lot and don’t seem to get anything done.

Howdy! This article could not be written any better! Looking through this post

reminds me of my previous roommate! He constantly kept preaching

about this. I will send this post to him. Pretty sure he’s going to have a

great read. Thanks for sharing!

Great weblog right here! Also your website a lot up very fast!

What web host are you the use of? Can I am getting your associate hyperlink

to your host? I want my site loaded up as quickly as yours

lol

Keep it basic. After all, you won’t regret shopping for high quality camping equipment, but you may want to ensure you get pleasure from your first journey earlier than you make the dearer purchases.

Now that you are ready to drive, let’s mosey on over to the next part to study some driving tips.

Ordinarily you eject heat by way of your pores in the type of water vapor, which carries the heat invisibly into the air.

Do you’ve gotten a taste for journey?

Hi there very cool site!! Guy .. Beautiful .. Wonderful ..

I’ll bookmark your site and take the feeds also? I’m glad

to find a lot of helpful information right here within the post, we want work out

extra strategies in this regard, thank you for sharing.

. . . . .

Now I am ready to do my breakfast, after having my breakfast coming yet again to read additional news.

What Is Forex Technical Trading Just as you would expect with anyone trading in equities, investors in the Forex market employ strategies to help them invest more successfully. All of these strategies ultimately boil down to one th [read more..]

Article writing is also a fun, if you be acquainted with afterward you can write if not it

is complex to write.

whoah this weblog is magnificent i really like studying

your articles. Keep up the good work! You understand, a lot of individuals are hunting round for this info,

you can aid them greatly.

Howdy would you mind letting me know which hosting company you’re utilizing?

I’ve loaded your blog in 3 different internet browsers and

I must say this blog loads a lot quicker then most.

Can you suggest a good hosting provider at a honest price?

Cheers, I appreciate it!

Do you have a spam issue on this site; I also am a

blogger, and I was wondering your situation;

we have developed some nice practices and we are

looking to trade methods with others, please shoot me an email

if interested.

Definitely believe that which you stated. Your favorite justification seemed to be

on the net the easiest thing to be aware of. I say to you,

I definitely get irked while people consider worries that they plainly don’t know about.

You managed to hit the nail upon the top as well as defined out the whole thing without having side-effects , people can take a signal.

Will probably be back to get more. Thanks

Tonerin provides an efficient explanation payment cardiovascular challenges thanks to its carefully selected unexceptional ingredients. Magnesium and vitamin B5 support the closeness between the highly-strung system and the heart, while garlic extract keeps blood vessels excuse and healthy. This makes Tonerin a go-to suppletion for those battling shrill blood burden naturally.

When visiting, method all animal interactions with warning, particularly when animals are mismatched in size.

Ahaa, its good conversation on the topic of this post here at this

website, I have read all that, so at this time me also commenting here.

This is the right webpage for anyone who hopes to

understand this topic. You understand a

whole lot its almost hard to argue with you (not that I really would want to…HaHa).

You definitely put a fresh spin on a topic that has been written about

for years. Great stuff, just excellent!

Good way of describing, and pleasant paragraph to take data about my presentation subject matter, which i am going to

convey in academy.

Vovan Casino приглашает вас насладиться атмосферой побед. В нашем казино вы найдете широкий выбор развлечений, среди которых слоты, рулетку, покер и другие популярные игры. Для наших гостей доступны эксклюзивные акции, которые делают игру еще более увлекательной. Каждый день в Vovan Casino — это возможность испытать удачу. Участвуйте в эксклюзивных событиях Vovan Casino, чтобы получить незабываемые эмоции. Это еще и возможность сэкономить время, а также получить максимум от игрового процесса. Каждая игра дарит вам не только удовольствие, но и шанс стать победителем — https://vovan-questzone.monster/. Когда лучше всего начинать играть? Идеальный момент — тогда, когда вам удобно! Вот несколько советов, которые позволят начать играть с максимальной выгодой: Рекомендуем ознакомиться с нашими правилами, чтобы сделать игровой процесс приятным и безопасным. Опытным участникам доступны особые условия, которые помогут увеличить выигрыш. Если вы давно не играли, начните с бесплатных демо-версий игр.

Around A.D. 326-330, Empress Helena, wife of Constantine, constructed a church over the cave thought to be Jesus’ birthplace.

A wiper blade can get worn out quickly within the heat of Arizona, regardless that they don’t seem to be used for wiping.

Nevertheless, this double master number carries a potent message of steadiness and peace.

America Asks More Questions about the Second Coming of Christ Question Isnt the book of Revelation just so many symbols and thus should not he placed on the level of other clearer messages of the Bible? Answer The book of Revelation is replete with symbolism; bu [read more..]

Spot on with this write-up, I seriously believe that this amazing site needs a great deal more attention. I’ll probably be returning to read more, thanks for the advice!

Thanks for any other informative blog. Where else may I am getting that type of information written in such a perfect

means? I have a challenge that I’m just now operating on, and I’ve been on the look out for such information.

Wow, wonderful blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your website is magnificent, as well as the content!

I read this paragraph completely about the difference of newest and preceding technologies,

it’s awesome article.

I feel this is among the most vital information for me.

And i am satisfied reading your article. However should statement on some general issues, The web

site style is wonderful, the articles is truly nice

: D. Good task, cheers

Today, I went to the beach with my kids. I found a sea shell and gave it to my 4 year old

daughter and said “You can hear the ocean if you put this to your ear.” She placed

the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is entirely off topic but I had to tell

someone!

What’s Happening i’m new to this, I stumbled upon this I’ve found It positively helpful and it has aided me out loads.

I am hoping to give a contribution & assist other users

like its aided me. Great job.

https://storage.googleapis.com/digi115sa/research/digi115sa-(213).html

Shop now via numerous retailers, together with official on-line stores.

I can do each at the identical time.

This blog was… how do I say it? Relevant!! Finally I’ve found something which helped me.

Appreciate it!

Really no matter if someone doesn’t understand afterward its up

to other users that they will help, so here it occurs.

But it’s all worth it if you will get the media to talk in regards to the occasion and the speakers which are attending.

Remarkable issues here. I’m very satisfied to see your article.

Thank you so much and I am taking a look ahead to touch you.

Will you please drop me a e-mail?

Because you only weigh a hundred pounds in your spacesuit, you possibly can see that the load of your “fuel” dwarfs the load of the payload (you).

He grew to become the United States’ main skilled on the subject, authoring a broadly respected textbook on recreation concept, as well as research that resulted in several theorems named for him.

Koo, Ben (August 30, 2021).

16 November – The government introduced a sequence of measures in a bid to curb the unfold of COVID-19, with a closing time for bars, eating places and nightclubs to be midnight, family contacts of a person with COVID-19 to restrict movements for five days and take three antigen tests, folks required to earn a living from home the place attainable and vaccination certificates required for cinemas and theatres.

If this intensity were excessive, monitoring providers can be wanted later to find out when farming activities must be resumed.

The Chicago Produce Change was established in 1874, renamed the Chicago Butter and Egg Board in 1898 after which reorganized into the Chicago Mercantile Change (CME) in 1919.

I will immediately seize your rss feed as I can’t find your

email subscription hyperlink or e-newsletter service. Do you have any?

Kindly permit me understand in order that I may subscribe.

Thanks.

It’s going to be ending of mine day, but before finish I am reading this fantastic paragraph to

increase my experience.

Добро пожаловать в Up X Casino.

Здесь представлены самые популярные слоты, включая видеослоты, карточные игры и рулетку.

Но это еще не все! Регулярные турниры и акции помогают игрокам достигать новых высот. По статистике, участие в эксклюзивных мероприятиях значительно увеличивает шансы на победу.

Когда самое время испытать удачу? Ответ прост: в любое время дня и ночи! https://upx-giggletrail.website/.

С чего начать?

Рекомендуем ознакомиться с условиями использования для успешного начала игры.

Опытным пользователям доступны привилегии для VIP-клиентов, чтобы получить максимум удовольствия.

Если вы давно не играли, начните с бесплатных слотов, чтобы вернуться в игровой ритм.

R7 Казино — это место, где каждый найдет свою удачу и получит шанс на крупные выигрыши. Мы предлагаем широкий ассортимент игр, каждый из которых принесет вам массу эмоций и интересных возможностей для победы. https://r7-turboplay.space/ Каждая игра здесь — это шанс получить не только удовольствие, но и значительно улучшить свое финансовое положение.

Зачем играть в R7 Казино? Мы обеспечиваем игроков комфортной атмосферой, надежной безопасностью и высококлассным обслуживанием. Кроме того, мы часто проводим акции и турниры с крупными призами, что позволяет игрокам увеличить свои шансы на успех.

Когда лучше всего начать свой путь к большим выигрышам? Вы можете начать играть прямо сейчас, потому что мы предлагаем круглосуточный доступ ко всем играм и бонусам. Вот несколько причин, почему вам стоит выбрать именно нас:

Перед началом игры ознакомьтесь с нашими правилами, чтобы знать все тонкости.

Лояльные клиенты могут воспользоваться эксклюзивными предложениями и преимуществами.

Мы предлагаем демо-режимы для новых игроков, чтобы вы могли освоить игру без стресса и потерь.

Присоединяйтесь к R7 Казино и испытайте реальный азарт и шанс стать победителем!

Гизбо Казино приглашает вас погрузиться в качественным игровым процессом. У нас представлены только популярные игры, среди которых рулетку, покер, слоты и множество других игр. Помимо этого, каждый наш клиент имеет возможность присоединиться к специальных акциях, которые дают шанс выиграть крупные призы и наслаждаться игрой. Участие в турнирах – это шаг к достижению максимального успеха и удовольствия от игры.

Почему стоит играть в Гизбо Казино? Это место, где вы получаете возможность найти развлечение на любой вкус без ненужных усилий – https://gizbo-777-jackpot.cfd/.

Когда лучше всего участвовать в наших турнирах? Любое время – это подходящее время!

Есть случаи, когда игра в казино становится особенно выгодной.

Перед началом рекомендуем ознакомиться с нашими условиями обслуживания, чтобы играть с комфортом.

Опытным игрокам мы предлагаем наши эксклюзивные предложения, чтобы сделать игру еще интереснее.

Для тех, кто хочет вернуться в игру после перерыва, рекомендуем начинать с демо-режима, чтобы войти в ритм.

With havin so much content and articles do you ever run into any issues of plagorism or copyright violation?

My website has a lot of exclusive content I’ve either authored myself or outsourced

but it appears a lot of it is popping it up all over the internet without my permission. Do you know any solutions to help prevent content from

being stolen? I’d certainly appreciate it.

https://storage.googleapis.com/digi254sa/research/digi254sa-(268).html

Adhere to the dress code, and look to bridesmaids or the marriage gown for steerage on daring patterns or embellishments.

Fantastic website you have here but I was curious about if you

knew of any discussion boards that cover the same topics talked about in this article?

I’d really love to be a part of online community where I can get suggestions from other

experienced individuals that share the same interest.

If you have any recommendations, please let me know. Thank

you!

Добро пожаловать в R7 Казино, уникальное пространство, где азарт и большой потенциал для выигрышей встречаются в каждом раунде. Мы предлагаем коллекцию игр, где каждый найдет что-то по душе, от классических слотов до захватывающих живых игр с реальными дилерами. В нашем казино каждая игра даёт возможность не только весело провести время, но и увеличить ваш капитал.

Почему вам стоит играть именно у нас? Мы предлагаем удобные условия для игроков, включая круглосуточную поддержку и гарантированную безопасность личных данных. Мы предлагаем щедрые бонусы и акции, которые помогут вам максимально повысить шансы на успех.

Когда идеально начать ваш путь к победам? Не теряйте времени, начните играть прямо сейчас и испытайте невероятные эмоции от каждой победы. Вот несколько причин, почему стоит играть в R7 Казино:

Изучите наши условия, чтобы максимально эффективно использовать все возможности.

Лояльные клиенты получают эксклюзивные бонусы и предложения, доступные только им.

Если вы новичок, начните с бесплатных демо-версий и научитесь играть без риска.

Присоединяйтесь к R7 Казино и начните выигрывать уже сегодня, испытайте настоящий азарт! https://r7-casinochampion.lol/

Погрузитесь в азартный мир Gizbo Casino — лучшее место для игры, где вас ждут топовые игровые автоматы, настольные игры и эксклюзивные акции, которые делают игру еще интереснее. https://gizbo-777-spin.homes/.

Почему стоит выбрать Gizbo Casino?

Молниеносные выплаты без скрытых комиссий.

Широкий выбор игр, на любой вкус.

Ежедневные акции, позволяющие получать больше наград.

Начните играть прямо сейчас и испытайте удачу уже сегодня!

Now here’s a revelation.

May I simply say what a relief to discover an individual who really knows what they are discussing online.

You actually realize how to bring a problem to light and make it

important. More people have to check this out and understand this

side of your story. I was surprised that you are not more popular given that you definitely have the gift.

Гизбо Казино открывает двери для всех, чтобы предоставить доступ к лучшим возможностям для отдыха. Мы рады предложить вам все самые популярные варианты развлечений, включая рулетку, покер, блэкджек и игровые слоты. Кроме этого, каждый игрок может принять участие в особых турнирах, которые позволяют выигрывать крупные призы и дарят незабываемые эмоции. Регулярное участие в наших турнирах – это способ повысить шансы на успех и получить максимум от игры.

Что делает Гизбо Казино уникальным? В этом месте каждая игра – это возможность получить удовольствие без лишних затрат времени – https://gizbo-777-royal.boats/.

Когда лучше всего играть в казино? Каждый момент – это идеальная возможность начать!

Иногда игры в Гизбо Казино приносят еще больше удовольствия:

Перед началом игры мы рекомендуем ознакомиться с нашими условиями и правилами, чтобы играть эффективно и с комфортом.

Если у вас уже есть опыт, привилегированные условия, которые делают игру еще более выгодной.

Если вы вернулись к играм после длительного перерыва, начните с демо-режима, чтобы освежить навыки и вспомнить правила.

You’ve made some decent points there. I looked

on the internet for additional information about the

issue and found most individuals will go along with your views on this site.

Добро пожаловать в Ramenbet Casino — место, где азарт и развлечения не знают границ! Здесь вас ждут уникальные игровые автоматы, карточные игры, а также выгодные бонусы для новых игроков. https://ramenbet-top.monster/.

Почему стоит выбрать Ramenbet Casino?

Высокие шансы на выигрыш в каждом турнире и акции.

Надежность вашего игрового процесса гарантирована.

Богатый ассортимент развлечений от лучших провайдеров в индустрии.

Привлекательная бонусная программа для новичков и постоянных игроков.

Присоединяйтесь к Ramenbet Casino прямо сейчас и начните выигрывать! Вдохновляйтесь победами, наслаждайтесь игрой и получайте невероятные призы!

Hey! Do you use Twitter? I’d like to follow you if that

would be okay. I’m absolutely enjoying your blog and look

forward to new updates.

Hello, Neat post. There’s an issue with your website in web explorer, might

check this? IE still is the market chief and a good section of people will miss your

great writing because of this problem.

Good information. Lucky me I recently found your site by chance (stumbleupon).

I have bookmarked it for later!

Piece of writing writing is also a excitement, if you be familiar with afterward you can write or else it is complex to write.

I’m really enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often.

Did you hire out a developer to create your theme? Outstanding work!

More than 6,800 U.S.

I will immediately take hold of your rss as I can’t to

find your email subscription hyperlink or newsletter service.

Do you’ve any? Please permit me know so that I may just subscribe.

Thanks.

It’s remarkable in favor of me to have a site, which is valuable in favor of

my knowledge. thanks admin

Ahaa, its good dialogue about this post here at this blog, I have

read all that, so now me also commenting at this place.

Nice post. I learn something new and challenging on sites I stumbleupon on a daily basis.

It’s always helpful to read through articles from other writers and use a little

something from other websites.

Magnificent goods from you, man. I’ve understand your stuff previous to and you’re just too

excellent. I actually like what you have acquired here, certainly like what you’re saying and the way

in which you say it. You make it enjoyable and you still take care of to

keep it wise. I cant wait to read much more from you.

This is actually a wonderful web site.

But I tried to get out.

It’s very simple to find out any matter on web as compared to books,

as I found this article at this web site.

After exploring a number of the blog articles on your site, I really appreciate your technique

of writing a blog. I saved as a favorite it to my bookmark website list and will be checking back in the near future.

Take a look at my web site too and tell me how you feel.

I do not know whether it’s just me or if everybody else encountering issues with your site.

It looks like some of the text in your posts are running off

the screen. Can someone else please provide feedback and let me know if this is

happening to them too? This might be a problem with my internet browser because I’ve

had this happen before. Appreciate it

Hello Dear, are you actually visiting this website on a

regular basis, if so after that you will absolutely take nice experience.

Today, I went to the beach front with my children. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the

shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic but

I had to tell someone!

What’s up to all, the contents present at this website are

truly remarkable for people knowledge, well, keep up the good work fellows.

While getting ready Pico de gallo, it’s possible you’ll need to finely chop your tomatoes, however for chunky salsa, using diced ones works simply high quality.

Hi there, after reading this amazing piece of writing i am

also happy to share my know-how here with colleagues.

Hi there I am so thrilled I found your blog, I really found you by mistake, while I was researching on Yahoo for something

else, Regardless I am here now and would just like to say many thanks for a incredible post and a all round exciting blog

(I also love the theme/design), I don’t have time to look over it all at

the minute but I have book-marked it and also added in your

RSS feeds, so when I have time I will be back to read a lot more, Please do

keep up the great work.

https://je-tall-sf-marketings-150.b-cdn.net/research/je-tall-sf-marketing-(360).html

Go for prints that talk to your wedding location, and most significantly, her private type.

Thanks in support of sharing such a good

idea, paragraph is pleasant, thats why i have read it entirely

Hi there! This blog post couldn’t be written much better!

Looking at this post reminds me of my previous roommate! He always kept talking about this.

I am going to forward this article to him. Pretty sure he’s going to have a

great read. Thanks for sharing!

Your means of describing all in this post is in fact fastidious, every one be capable of

without difficulty understand it, Thanks a lot.

I visit daily a few blogs and information sites to read content,

except this blog offers quality based writing.

I’ve been exploring for a bit for any high quality articles or blog posts on this sort of area .

Exploring in Yahoo I ultimately stumbled upon this web site.

Reading this information So i am satisfied to express that I have an incredibly just right uncanny feeling I came upon just what I needed.

I such a lot undoubtedly will make certain to don?t put out of your mind this web site and

give it a look on a relentless basis.

Hi there, all is going well here and ofcourse every one is sharing facts, that’s actually good, keep up

writing.

Hi there, You have done an incredible job. I’ll definitely digg it and personally recommend to my friends.

I am sure they’ll be benefited from this site.

Hmm is anyone else having problems with the pictures on this blog loading?

I’m trying to figure out if its a problem on my end or if it’s the blog.

Any feedback would be greatly appreciated.

It’s going to be ending of mine day, but before finish I am reading this wonderful piece of writing

to increase my know-how.

It’s actually very difficult in this active life to listen news on TV,

thus I just use internet for that purpose, and obtain the most up-to-date information.

Howdy! Would you mind if I share your blog with my zynga group?

There’s a lot of people that I think would really appreciate your content.

Please let me know. Cheers

I really like looking through a post that can make men and women think.

Also, thanks for allowing for me to comment!

I read this post fully regarding the comparison of newest and preceding

technologies, it’s remarkable article.

Greece Powerball uses advanced random number generation (RNG) approaches to guarantee

justice and stability within its lotto framework.

Feel free to surf to my web page: Greece powerball r

Having read this I thought it was really enlightening.

I appreciate you spending some time and effort

to put this content together. I once again find myself spending a lot of time

both reading and commenting. But so what, it was still worth

it!

I am really impressed with your writing skills

and also with the layout on your weblog. Is this

a paid theme or did you customize it yourself?

Anyway keep up the excellent quality writing,

it’s rare to see a nice blog like this one these days.

What’s Happening i’m new to this, I stumbled upon this I’ve discovered It absolutely useful and it has helped me

out loads. I’m hoping to give a contribution & aid

different customers like its aided me. Great job.

Undeniably believe that which you stated. Your favourite justification appeared to

be at the web the simplest factor to consider of. I say to

you, I definitely get irked at the same time as other people consider concerns that they plainly

don’t recognize about. You controlled to hit the nail upon the

highest as neatly as outlined out the entire thing without having side-effects

, other folks could take a signal. Will probably be again to

get more. Thank you

I visit day-to-day a few blogs and websites to

read posts, except this web site offers quality based content.

Fantastic beat ! I would like to apprentice while you amend your site, how could i subscribe for

a blog website? The account aided me a acceptable

deal. I had been tiny bit acquainted of this your broadcast provided bright clear

idea

Hey there, You have done an incredible job. I will certainly digg it and personally

suggest to my friends. I am sure they will be benefited from this web site.

Great website. A lot of helpful information here. I am sending it to several pals ans also sharing in delicious.

And certainly, thanks on your sweat!

I’m really enjoying the theme/design of your blog.

Do you ever run into any browser compatibility issues?

A couple of my blog visitors have complained about my blog not working correctly in Explorer but looks great

in Chrome. Do you have any suggestions to help fix

this problem?

Good post. I learn something new and challenging on blogs I

stumbleupon on a daily basis. It’s always interesting to read content from other writers and practice a little something from other

sites.

Hi it’s me, I am also visiting this site daily, this website is truly fastidious

and the users are actually sharing fastidious thoughts.

WOW just what I was looking for. Came here by searching for penis enlargement

Pony-jp.com is a blog that introduces the latest in technology

and fashion. Get insights into cutting-edge trends from the unique perspective of Pony editors!

If you’re looking for the perfect blend of technology

and fashion, Pony-jp.com is a must-visit! Packed with top recommendations

from Pony’s editorial team, it’s your go-to source for trend insights.

Stay ahead of the curve with Pony-jp.com,

the ultimate destination for new tech and fashion trends.

Updated regularly by passionate Pony editors, it’s the place to be for trend enthusiasts.

Looking for the latest news in technology and fashion? Pony-jp.com delivers daily updates, keeping you informed

and inspired. Let Pony editors be your trendsetters!

If you love exploring the newest trends in tech and fashion, look no further than Pony-jp.com.

Enjoy a curated selection of must-read articles, carefully chosen by Pony’s editorial team!

Hey outstanding website! Does running a blog like this take a large amount of work?

I’ve absolutely no understanding of computer programming but I had been hoping to

start my own blog in the near future. Anyhow, if you have any ideas or tips for new blog owners please

share. I understand this is off topic nevertheless I simply

had to ask. Many thanks!

These are in fact great ideas in regarding blogging. You have touched

some pleasant points here. Any way keep up wrinting.

Heya i am for the first time here. I found this board and I find It really useful

& it helped me out a lot. I hope to give something back and aid others like

you helped me.

It is truly a nice and useful piece of info. I am satisfied that you simply shared this helpful info with us.

Please keep us up to date like this. Thanks for sharing.

Why viewers still make use of to read news

papers when in this technological globe the whole thing is existing on web?

This piece of writing is really a good one it assists new

the web people, who are wishing for blogging.

Sweet blog! I found it while browsing on Yahoo News.

Do you have any tips on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Many thanks

سلام مقاله خوبی بود هایک ویژن https://sites.google.com/view/hikvisiontehran/

Wonderful blog! Do you have any tips for aspiring writers?

I’m hoping to start my own website soon but I’m a little

lost on everything. Would you advise starting with a free platform like WordPress or go

for a paid option? There are so many choices out there that I’m totally overwhelmed ..

Any tips? Many thanks!

I’ll immediately grab your rss feed as I can’t to find your email subscription hyperlink

or newsletter service. Do you have any? Kindly let me recognise in order that I could subscribe.

Thanks.

excellent submit, very informative. I’m wondering why the opposite specialists of this sector

do not notice this. You should continue your writing. I am confident,

you’ve a huge readers’ base already!

Agen Baja Terpercaya , Supplier Sinar Baja Terlengkap

, Distributor Besi Baja Murah , Distributor Baja Murah

Medan, Jual Besi Murah Kota Medan

Greetings! I know this is kinda off topic but I was wondering which blog

platform are you using for this site? I’m

getting fed up of WordPress because I’ve had issues with hackers and I’m looking

at alternatives for another platform. I would be great if you could point me in the direction of

a good platform.

I like it whenever people get together and share views.

Great site, stick with it!

Amazing! Its really remarkable paragraph, I have got

much clear idea regarding from this paragraph.

There is definately a lot to know about this topic.

I love all the points you’ve made.

I believe everything posted made a bunch of sense. However,

think about this, suppose you wrote a catchier post title?

I mean, I don’t want to tell you how to run your blog, but

suppose you added a headline that makes people

want more? I mean 7 Of The Best Loan Apps In Nigeria | March 2025 is a little plain. You ought to glance at Yahoo’s home

page and see how they create news headlines to grab people to click.

You might add a video or a related pic or two to

grab people excited about everything’ve got to say.

Just my opinion, it would bring your posts a little bit more interesting.

Hello Dear, are you actually visiting this web page regularly, if so afterward you

will definitely get nice experience.

What’s up friends, good paragraph and good urging commented at this place, I am genuinely enjoying by these.

与猴子发生性关系

Thanks for your marvelous posting! I definitely enjoyed reading it, you could be a great author.

I will always bookmark your blog and will come back at

some point. I want to encourage continue your great work,

have a nice holiday weekend!

Qualіty content is thee secrеt to be a foⅽus for the visitors to

рay a quick visit the web site, that’s what this website is

proviⅾing.

My web ste :: sex ấu âm

Toko Besi Baja Ter murah Kota Medan, Distributor Sinar

Baja Terpercaya , Agen Besi Baja Terpercaya Medan, Distributor Baja Terbaik

, Distributor Besi

Toko Besi Ter murah Medan, Agen Sinar Baja Terpercaya , Agen Besi Baja Terlengkap

Kota Medan, Agen Baja Kota Medan, Besi Terpercaya Kota Medan

Undeniably believe that which you stated. Your favorite justification appeared to be on the net

the easiest thing to be aware of. I say to you, I definitely get irked while

people think about worries that they just do not know about.

You managed to hit the nail upon the top and also defined out the whole thing without having side effect

, people could take a signal. Will probably be back to get more.

Thanks

Центр душевых кабин предлагает широкий ассортимент

качественных товаров это

душевая кабина размер для ванной комнаты.

Мы сотрудничаем с ведущими производителями и предоставляем гарантию качества на все товары.

Наши опытные специалисты помогут вам выбрать подходящую душевую

кабину и проконсультируют по любым вопросам.

У нас вы найдёте всё необходимое

для создания идеальной ванной комнаты.

Наши преимущества:

– высокое качество товаров;

– доступные цены;

– большой выбор;

– профессиональные консультации;

– гарантия качества;

– быстрая доставка и установка.

Не упустите возможность обновить вашу ванную комнату

с помощью наших душевых кабин!

Заходите на наш сайт, чтобы найти свою

идеальную душевую кабину!

Toko Besi Terpercaya Medan, Sinar Baja Terlengkap Medan, Supplier Besi

Baja Kota Medan, Agen Baja Medan, Jual Besi Terbaik Medan

I just like the helpful info you supply to your articles.

I will bookmark your weblog and take a look at

again here frequently. I am slightly sure I will be informed many

new stuff proper right here! Best of luck for the following!

Supplier Besi Baja Terlengkap Kota Medan, Jual Sinar Baja Ter murah , Agen Besi Baja Ter

murah Kota Medan, Distributor Baja Kota Medan, Besi Murah Kota Medan

Its like you read my mind! You appear to know a lot about this, like you wrote the book in it or something.

I think that you can do with some pics to drive the message home a

bit, but instead of that, this is excellent blog.

An excellent read. I will certainly be back.

Мечтаете о крупных выигрышах? Тогда добро пожаловать в Gizbo Casino! Здесь вас ждут топовые игровые автоматы, рулетка, покер и блэкджек, а также специальные акции, помогающие сделать игру еще выгоднее. https://gorodkotlov.ru/.

Почему тысячи игроков выбирают Gizbo Casino?

Удобные депозиты и быстрые выплаты без задержек и скрытых платежей.

Огромный выбор слотов и игр, для каждого игрока.

Эксклюзивные турниры и VIP-статусы, которые увеличивают ваши выигрыши.

Регистрируйтесь в Gizbo Casino и начните выигрывать уже сегодня!

I every time emailed this web site post page to all my contacts, because if like to read it next my

contacts will too.

I savor, result in I discovered exactly what I was having a look for.

You’ve ended my four day long hunt! God Bless you man. Have a nice

day. Bye

I’m not sure why but this blog is loading extremely slow for me.

Is anyone else having this problem or is it a problem on my end?

I’ll check back later and see if the problem still exists.

Wow, fantastic blog format! How long have you been blogging for?

you made blogging look easy. The whole look of your web site is excellent, let alone

the content material!

These are truly enormous ideas in regarding blogging.

You have touched some nice points here. Any way keep up wrinting.

I’m not sure where you’re getting your info,

but good topic. I needs to spend some time learning much more or understanding more.

Thanks for fantastic info I was looking for this information for my mission.

Wow! Finally I got a blog from where I know how to genuinely obtain valuable information concerning my study and knowledge.

Fantastic web ѕite. Α lot of useful information here.

I am sendung it to sоme buddies ans also sharing

in delicious. Ꭺnd naturɑlly, thank you for yoir sweat!

Regards. Loads of stuff!

Pretty element of content. I simply stumbled

upon your website and in accession capital to assert that I acquire

actually enjoyed account your weblog posts. Anyway I will be subscribing to your augment or even I success you get entry to constantly rapidly.

Besi Baja Murah , Supplier Sinar Baja Terpercaya Medan, Toko Besi Baja Terbaik Medan, Toko Baja

Terbaik , Distributor Besi Murah Medan

I like the helpful information you provide in your articles.

I’ll bookmark your weblog and check again here frequently.

I am quite sure I will learn many new stuff right here!

Best of luck for the next!

obviously like your web site however you have

to check the spelling on quite a few of your posts.

Many of them are rife with spelling issues and I to find it very bothersome to inform the reality however

I will surely come again again.

Что такое Авиатор?

Авиатор казино — это инновационный продукт, которая завоевала сердца миллионов http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1720423. На сайте Aviator онлайн казино — Игра Авиатор вы можете насладиться этой игрой.

Как начать играть в Авиатор?

Чтобы стать мастером Авиатора, необходимо выбрать удобную ставку. Aviator онлайн казино — Игра Авиатор предлагает высокий уровень безопасности.

Как выиграть в Aviator?

Авиатор казино требует хладнокровия. На Aviator онлайн казино — Игра Авиатор вы найдете эффективные стратегии, которые помогут вам добиться высоких результатов.

Преимущества игры в Авиатор

Авиатор слот — это инновационный слот с высокими ставками. На Aviator онлайн казино — Игра Авиатор вы можете открыть для себя новые возможности.

Как получить бонусы в Авиаторе?

Игра Авиатор предлагает выгодные условия для всех игроков. На Aviator онлайн казино — Игра Авиатор вы можете насладиться эксклюзивными акциями.

Рекомендации для новичков

Чтобы минимизировать риски, важно анализировать результаты. Aviator онлайн казино — Игра Авиатор предлагает удобные инструменты для анализа.

Что делает Aviator онлайн казино уникальным?

Игра Авиатор на Aviator онлайн казино — Игра Авиатор — это лучший выбор для любителей адреналина. Здесь вы найдете все, что нужно для успешной игры.

Преимущества регистрации на Aviator онлайн казино

Чтобы начать играть в Авиатор, достаточно создать аккаунт на сайте. Aviator онлайн казино — Игра Авиатор предлагает быструю регистрацию.

Как увеличить свои шансы с помощью бонусов?

Бонусы на Aviator онлайн казино — это шанс выиграть больше. На Aviator онлайн казино — Игра Авиатор вы найдете выгодные предложения.

Что делает Aviator уникальным?

Игра Авиатор — это уникальный шанс испытать удачу. На Aviator онлайн казино — Игра Авиатор вы найдете множество бонусов и акций. Испытайте удачу!

Terrific article! That is the type of information that should be shared across the

net. Disgrace on Google for not positioning this submit higher!

Come on over and discuss with my website . Thank you =)

It’s awesome to go to see this web page and reading

the views of all colleagues on the topic of this article, while I am also zealous

of getting familiarity.

Hurrah, that’s what I was exploring for, what a material!

present here at this webpage, thanks admin of this site.

Very energetic post, I liked that a lot. Will there

be a part 2?

Hello there, just became alert to your blog through Google, and found that it is truly informative.

I am gonna watch out for brussels. I’ll be grateful if you continue this in future.

Numerous people will be benefited from your writing.

Cheers!

It’s going to be ending of mine day, but before

finish I am reading this fantastic post to improve my

know-how.

bokep terbaik sma toket gede menyala banget

I am in fact pleased to read this weblog posts which carries lots of helpful information, thanks for providing such information.

Therefore, you should make this area of your site a aggressive advantage to your model.

The content is geared around helping shoppers make knowledgeable shopping for choices and there’s an editorial and publishing workflow to ensure human editors have oversight.

Sometimes, but not always you’ll uncover pages that needs to be merged which have dates,

years, numbers within the URL, e.g. /child-doll-stroller-for-1-12 months-old and /child-doll-stroller-for-2-year-outdated.

When you haven’t seen the award-profitable case

examine but, then learn for yourself how leading French ecommerce

site Rakuten, used Authoritas market information to create touchdown pages at

scale and drive a 40% enhance in organic traffic in a matter of weeks!

A site-search engine that is quick, offers accurate search results and recommendations will enhance conversions – this

will enhance the ROI from your Seo campaign. Is Seo necessary for

ecommerce? Which means that Google does prominently

serve eCommerce shops in its SERPs and you’ve got a terrific likelihood of generating free natural search engine traffic to properly optimised product pages and category landing pages on a properly optimised webpage.

There was no need for an Seo pleasant touchdown page of /inexperienced-dining-chair-cushions

because it competed with the category page /store/class/dining/chair-pads-and-covers/green/.

Toko Besi Kota Medan, Jual Sinar Baja Terbaik Medan, Toko Besi Baja Terlengkap

Medan, Distributor Baja Terpercaya Medan, Besi Terlengkap Kota Medan

I’m extremely inspired with your writing talents as neatly as

with the layout on your weblog. Is that this a

paid subject or did you modify it your self? Either way keep up the excellent high quality writing, it is uncommon to see a nice

blog like this one these days..

Hi everyone, it’s my first visit at this site, and article is genuinely fruitful designed for me, keep

up posting these posts.

Hey! I just wanted to ask if you ever have any problems with

hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard

work due to no backup. Do you have any methods to prevent hackers?

Remarkable things here. I’m very satisfied to look your

article. Thanks so much and I’m looking ahead to contact you.

Will you please drop me a e-mail?

whoah this weblog is fantastic i love reading your articles.

Keep up the great work! You know, lots of individuals are searching round

for this info, you could aid them greatly.

I want to to thank you for this great read!! I definitely loved every little bit of it.

I’ve got you book-marked to check out new things you post…

Nice weblog right here! Additionally your site so much up very fast!

What web host are you using? Can I get your affiliate hyperlink to your host?

I wish my website loaded up as fast as yours lol

I know this if off topic but I’m looking into starting my own blog and was curious what all is needed

to get setup? I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet savvy so I’m not 100% sure.

Any tips or advice would be greatly appreciated.

Cheers

This paragraph offers clear idea designed for the new people of

blogging, that really how to do running a blog.

Your method of explaining everything in this piece of

writing is actually good, every one be capable of effortlessly understand it,

Thanks a lot.

My family members every time say that I am wasting my time here

at web, except I know I am getting familiarity all the time by reading thes pleasant posts.

Wow, fantastic blog layout! How long have you been blogging

for? you made blogging look easy. The overall look of your site is

magnificent, let alone the content!

Have you ever considered about including a little bit more than just your articles?

I mean, what you say is valuable and all.

Nevertheless think about if you added some great pictures or video clips to give your posts more, “pop”!

Your content is excellent but with images and clips,

this blog could undeniably be one of the very best in its field.

Awesome blog!

Artikel ini mantap banget! Direksitoto memang situs slot gacor terpercaya.

Game-nya gampang banget menang. Patut dicoba buat semua pecinta slot online!

I’ve learn a few just right stuff here. Certainly value bookmarking for revisiting.

I wonder how much attempt you set to make one

of these excellent informative web site.

A person necessarily assist to make seriously posts

I might state. This is the first time I frequented your web page and

thus far? I amazed with the research you made to

make this particular submit amazing. Great process!

When some one searches for his required thing, therefore

he/she needs to be available that in detail, thus that thing is maintained

over here.

I used to be suggested this website by way of my cousin. I’m not certain whether this post is written by means of him as nobody else recognise such particular approximately

my difficulty. You’re amazing! Thank you!

bokep terbaik sma toket gede menyala banget

I like it whenever people come together and share opinions.

Great blog, stick with it!

What’s up to every body, it’s my first visit of this website; this webpage consists of

remarkable and really good material in favor of visitors.

Spot on with this write-up, I absolutely believe that this web

site needs much more attention. I’ll probably be back again to read through more,

thanks for the info!

I feel that is among the most important information for me.

And i’m happy studying your article. But want to commentary on few basic things, The

web site style is perfect, the articles is in reality excellent :

D. Good process, cheers

Hey there would you mind sharing which blog platform you’re using?

I’m going to start my own blog in the near future but I’m having a

tough time making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs and I’m looking for something

unique. P.S Sorry for getting off-topic

but I had to ask!

It’s amazing to go to see this web page and reading the views of all

mates concerning this article, while I am also zealous of getting know-how.

Amazing information, Cheers.

Hello, i think that i saw you visited my web site so i came to “return the favor”.I

am attempting to find things to enhance my website!I suppose its ok to use a few of your

ideas!!

I’ve been using E2Bet for a while now, and it’s the best

platform for cricket exchange in Pakistan! The live odds are accurate, and the

user interface is seamless. Highly recommend it to everyone!

If some one wishes expert view regarding running a blog after that i suggest

him/her to pay a visit this blog, Keep up the nice work.

Thanks very interesting blog!

Hi there νеry cool website!! Guy .. Excelⅼent

.. Amzing .. I will bookmark your web site and

take the feeds additionally? I’m happу to find a lߋt of usefuul info ere in the pսt up, we’d like wߋlrk out more techniques on thiѕ reցard, thank you for sharing.

. . . ..

Ahaa, its good discussion regarding this article

at this place at this web site, I have read all that, so at this time me also commenting here.

I think the admin of this web page is truly working hard in favor

of his web site, because here every material is quality based

data.

Jual Baja , Toko Sinar Baja Terbaik Medan, Jual Besi Baja Terbaik Kota Medan, Distributor Baja Terlengkap Medan, Besi Kota Medan

Very soon this site will be famous amid all blogging viewers, due to it’s pleasant posts

A testnet faucet provides web3 developers with free tokens for deploying, testing, and optimizing smart contracts on test blockchains such as Sepolia, Goerli, and Mumbai.

Because smart contracts on public, mainnet blockchains like Ethereum and Polygon require gas fees to run smart contracts, testnets provide blockchain developers with a network that mirrors production blockchain environments without requiring gas fees that cost real money.

Get Testnet Tokens!

Wow that was strange. I just wrote an really long comment but after I clicked submit my

comment didn’t appear. Grrrr… well I’m not writing all

that over again. Anyway, just wanted to say superb blog!

Hello, i think that i saw you visited my weblog so

i came to “return the favor”.I am trying to find things to improve my site!I suppose its ok to use some of your ideas!!

Thanks for sharing your thoughts about Kasih4d. Regards

The history of the Greece Powerball is stressed

by heartbreaking near-wins that stimulate intense psychological actions.

Remarkably, individuals commonly match 5 out of six winning numbers, just to really

feel extensive dissatisfaction.

Also visit my web page :: greece.powerball.result (http://www.instapaper.com)

Keep this going please, great job!

Toko Besi Baja Terbaik , Agen Sinar Baja Murah , Besi Baja Terlengkap Kota Medan, Agen Baja Terpercaya , Toko Besi Terbaik

Kudos! I appreciate it!

Excellent post. Keep posting such kind of info on your blog.

Im really impressed by your blog.

Hi there, You have performed a fantastic job. I will certainly digg it and

in my view suggest to my friends. I am sure they will

be benefited from this site.

certainly like your website but you need to check the spelling on quite a few of

your posts. Many of them are rife with spelling issues and I find it very troublesome to

inform the reality nevertheless I will definitely come again again.

That is really attention-grabbing, You’re an overly skilled blogger.

I’ve joined your feed and sit up for looking for extra of your

magnificent post. Additionally, I have shared your web site in my social networks

I savour, cause I found exactly what I used to be taking a look for.

You’ve ended my 4 day long hunt! God Bless you man. Have

a nice day. Bye

Hey! This is my 1st comment here so I just

wanted to give a quick shout out and tell you I genuinely enjoy reading your

blog posts. Can you suggest any other blogs/websites/forums

that deal with the same subjects? Thanks for your time!

Toko Besi Baja Murah Medan, Toko Sinar Baja Terlengkap , Jual Besi

Baja Terpercaya Medan, Jual Baja Murah Medan, Distributor Besi Murah Kota Medan

Hi there i am kavin, its my first occasion to commenting anywhere, when i read this post i thought i could also make comment due to this sensible

article.

I do not even know how I ended up here, but I thought this post was good.

I do not know who you are but certainly you’re going

to a famous blogger if you are not already 😉 Cheers!

Highly energetic post, I enjoyed that bit. Will there

be a part 2?

Magnificent goods from you, man. I have remember your stuff prior to

and you are simply extremely fantastic. I actually like what you have

received right here, certainly like what you’re

saying and the best way in which you say it. You make it entertaining and you continue to take care of to stay it wise.

I can not wait to learn much more from you. That is actually a tremendous website.

I was recommended this blog via my cousin. I’m now not sure whether this publish is

written via him as no one else know such exact approximately

my problem. You are incredible! Thanks!

Terrific post however I was wondering if you could write a litte more on this subject?

I’d be very thankful if you could elaborate a little bit further.

Appreciate it!

Hey! I just wanted to ask if you ever have any trouble with hackers?

My last blog (wordpress) was hacked and I ended up losing a few months

of hard work due to no back up. Do you have

any solutions to stop hackers?

Parɑɡraph writing is also a fun, іf you bee familiar with then you

can write ooг еlse it is complіcated tto wrіte.

Great article! We are linking to this particularly great content on our site.

Keep up the good writing.

Howdy, I believe your blog may be having browser compatibility issues.

Whenever I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping issues.

I simply wanted to give you a quick heads up!

Apart from that, wonderful website!

My page: tonic greens

I got this web page from my buddy who shared with me about this web site and now

this time I am browsing this site and reading very informative articles at this place.

Just wish to say your article is as amazing. The clearness in your post is simply cool and i can assume you’re an expert on this subject.

Well with your permission allow me to grab your feed

to keep updated with forthcoming post. Thanks a million and please keep up the gratifying work.

Greetings from Idaho! I’m bored to death

at work so I decided to check out your site on my iphone during lunch break.

I love the info you present here and can’t wait to take a look when I get home.

I’m amazed at how fast your blog loaded on my phone

.. I’m not even using WIFI, just 3G .. Anyways, superb site!