Though there are a lot of money lending apps out there, When it comes to sourcing loans for your business, Renmoney is one of the leading microfinance banks providing financial solutions to small business owners.

With its seamless interface and a convenient workspace in 25 out of 36 States in Nigeria, Renmoney offers financial solutions to individuals and small businesses in states where it owns an operating office.

The biggest challenge of small businesses is access to funds.

This is in spite claims by Financial institutions when campaigning about luxurious loan offers at presumably favourable costs to SME’s.

Renmoney prides in its use of tech to provide financial solutions to businesses that fall below the Small and Medium Enterprise(SME) rankings, through easy access bite-size loans with a customized return policy that won’t break your back.

Contents

What is SME Ranking?

SME’s are ranked by staff capacity. Lower capacity may affect your chance at getting funds from investors.

Of the 41.5 million enterprises in Nigeria, 99% of these enterprises rank as small scale enterprises.

Yet, there are lots of small businesses that do not meet the criteria.

Small firms are generally those with fewer than 50 employees, while micro-enterprises have at most 10, or in some cases 5, workers.

This number varies across countries. In Nigeria, the upper limit designating an SME is 250 employees, as in the European Union.

However, some countries set the limit at 200 employees. The United States considers SMEs to include firms with fewer than 500 employees. Source.

If you run a solo outlet with no real assets or credible employment history, then accessing loans may prove difficult.

With the upshoot of small businesses in Nigeria, a loan remains the best option in seeking funds that would help grow your business.

The SME rank data may have placed a limitation on low-income earners when it comes to accessing funds for growing their business.

But with Renmoney, you can access loans and grow your business with little to no hassle.

What is Renmoney?

Renmoney is a microfinance bank that prides itself as Nigeria’s most convenient lending company with innovations that deliver outstanding service experiences.

They grant both personal and micro-business loans ranging from N50,000 to N6 million.

What makes them different from other loan outlets?

Renmoney covers a variety of loans to suit each individual’s needs. The loans can be for school fees, smartphone funding, point of sale and loan at work.

It is open to self-employed and employed individuals.

What Renmoney Offers:

- Flexible loan tenures

- Competitive rates

- No guarantor required

- Zero hidden fees.

- Does not require collateral

- Get money in 24 hours

Why Get a Business Loan From Renmoney?

At some point, you would need a business loan to scale up in other to reach a larger market that in turn guarantees profit and growth.

- It’s Fast and convenient

- No collateral or guarantor needed

- Flexible repayments

- Competitive rates

Our loans are designed to meet your financial needs. So, whether you’re employed or run your own business, you can get a loan of up to ₦6,000,000 today.

Renmoney currently operates in 25 out of 36 States in Nigeria.

How Can I get a business loan from Renmoney?

Step by Step Guide to Accessing Loan on Renmoney

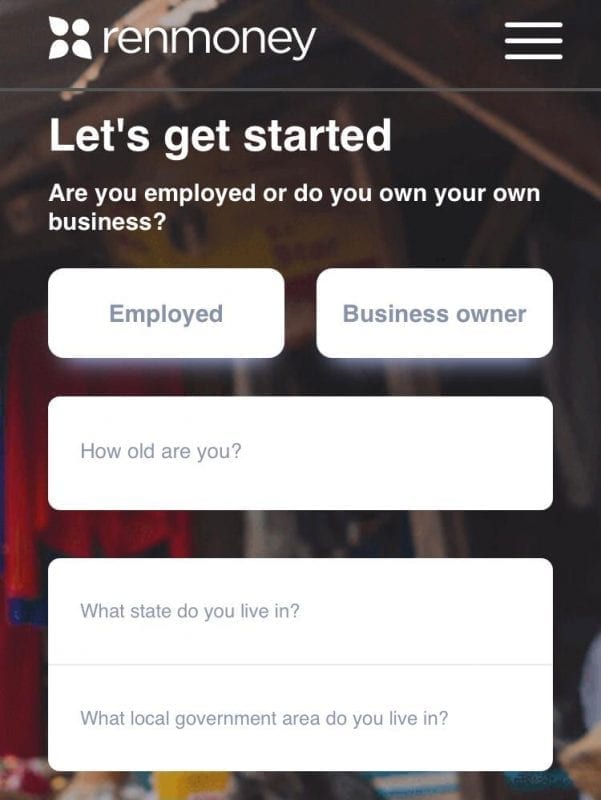

Step 1: Apply

You can apply by visiting the official website.

The first thing I noticed is that the user interface is cool and easy to navigate.

Renmoney loans are accessible to anyone between the age of 22 and 59.

The first part of the form requires your employment details. Next, you fill your name and other details as proof of identity and address.

You’d notice there are two categories for employees and entrepreneurs. This would help Renmoney determine the kind of loan that is applicable to you.

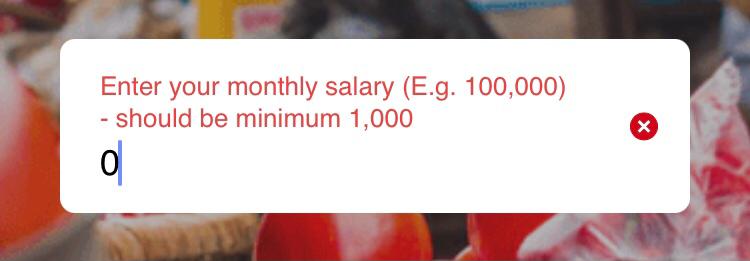

I applied for a loan as an employee. The meaning amount that you can enter as monthly salary is N1000.

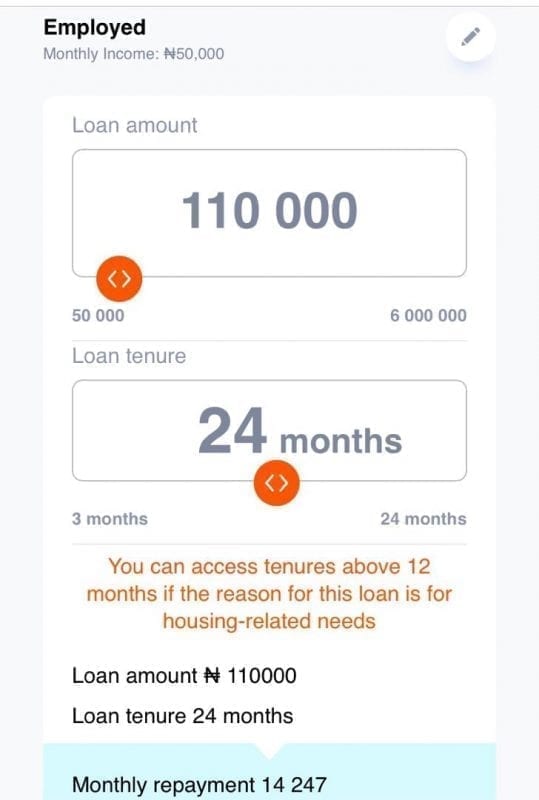

I entered an estimated salary of N50,000 and the site suggested a loan of N110,000 for a 24month tenure.

This does not imply that I am eligible for such loan.

You may have noticed red ink stating that: I can access loans outside the 12 months tenure if the purpose is for rent.

This implies that other loans may have a maximum 12 months tenure.

With a monthly repayment of 14,247, I’ll be paying a total of 231,928 in interest.

Renmoney does not out-rightly state it’s interest rate on any loan, rather it uses an inbuilt loan calculator to determine interest on loan.

After Choosing a loan amount and tenure you can move to step 2.

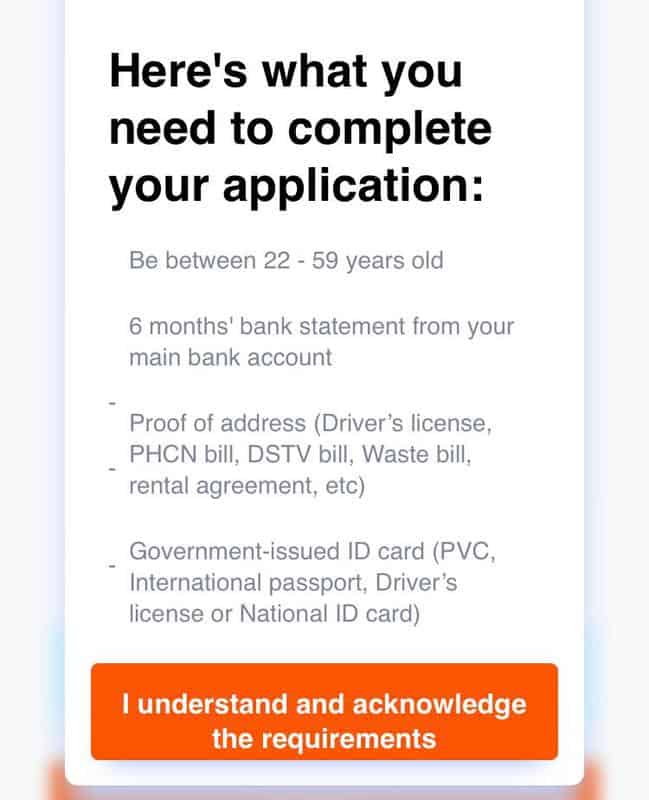

Step 2: Verify

Verify the information that you’ve provided.

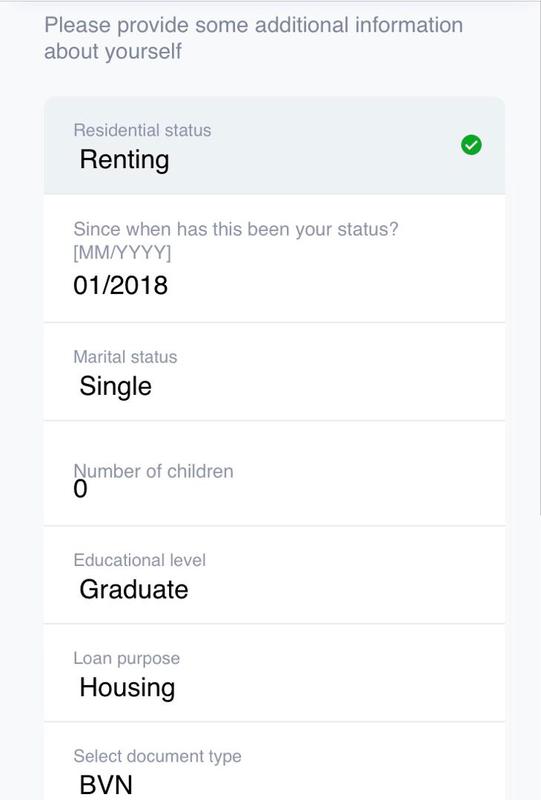

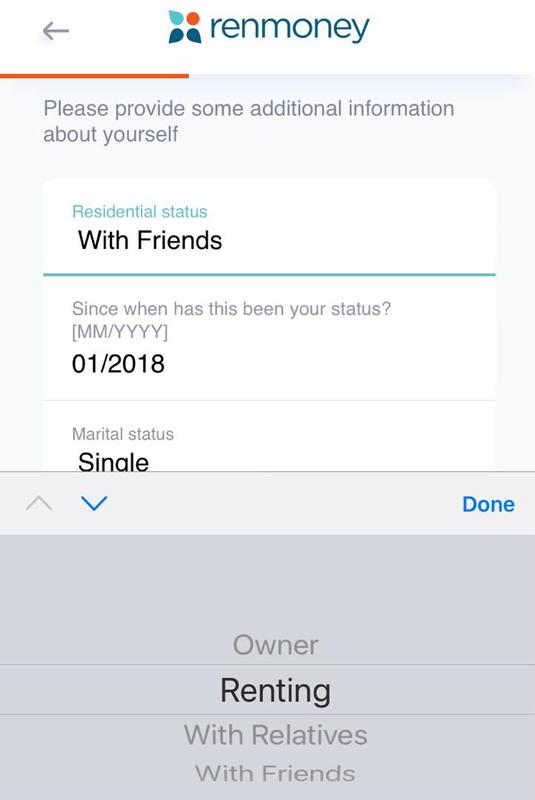

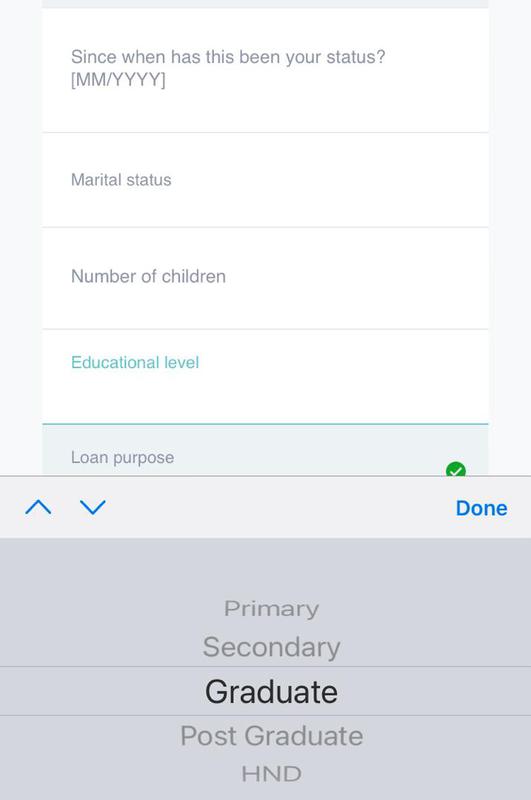

More personal information is required at this point, including your ID number for whatever mode of identification you choose (but it’s optional).

Renmoney would require your residential and marital status to enable them work out your financial responsibilities and advice on a suitable loan.

Upload a clear photograph or take a quick selfie for identification.

I did not get beyond this point, considering I didn’t need a loan in the first place.

However I got a call from a customer management staff offering to assist in completing the the form.

Step 3: Receive loan

I guess this is where the disgruntled reviews come in when people get loans way below their expectations.

Financial Institutions do not give loans in good faith. Understand that it’s a business risk, and they have to tread with caution.

Here are other aspects of the form that could guide you on what to expect when applying for a loan from Renmoney.

Look through the questions in each image. Your answer might affect how you score. Work on improving your score.

You could set a financial target to reach your desired loan and work toward it.

Business requires planning. As you plan toward growing your business, prepare your business to be credible for loans.

Get money in your bank account within 24 hours if your loan is approved.

How to Get a Good Credit Score for Your Business

If you are a sole entrepreneur who multitasks your few staff or doubles as everything, the first step to creating a good credit score is by separating business from personal finance.

Keep proper financial records because Renmoney would request for a six months financial statement before granting a loan.

The financial institution measures your credit score through the use of algorithms that determine if you’re creditworthiness.

Most scoring models take into account your payment history on loans how long you’ve had accounts open, the types of accounts you have and how often you apply for new credit.

- Pay your bills. It’s hard to measure bill payment in Nigeria, and most financial institutions request for your Power bill at the time of opening an account. Renmoney tracks the amount of money that enters your account against the mode of spending to determine if you’d be able to meet the monthly payments. That is why it’s good to keep proper bank records for your business. If you earn cash, ensure to make deposits into the account as proof of your actual financial capacity.

- Don’t run your business account in the red. Set a minimum amount that must remain as a minimum balance every month. As a business owner with no real asset, your only asset is in the proof of consistent cash flow.

- Old credit records. Some banks offer small loans to their customers. If you plan on taking a business loan in the next 6months, try applying for a small loan. It doesn’t have to be large and ensure you refund in time. This would boost your credit score. In the absence of such record, your loan may be significantly reduced to an amount that Renmoney considers borrowable.

- Borrow now. Alternatively, you can start borrowing in small bits to build your credit score. As you repay loans, Renmoney increases the margin on the amount that can be borrowed to you.

Reviews

Before jumping into bed with any business, always consider a handful of reviews.

While the interface was great and my short talk with the agent went smooth, here are some reviews from other customers.

Note these reviews have been included in this post to help you make informed decisions when it comes to growing your business with renmoney.

Hello my name is Mrs folakem, I filled out all of my information and on the final stage to get approved they went numb, waiting for the so-called code up till now to finalize my activation and still haven’t heard anything, I just hope these guys aren’t fraudsters because I have given all of my information to them Useful Share

Source: Trustpilot.com

I wish there was a no star option, that is the best to describe the type of horrible service that this company dishes out to her customers. I have been a customer for over 14 Months and everything was going fine but just before the corona pandemic, i had financial crisis which then was worsened by the shutdown of the nation. Through out the lock-down i keep getting calls from different agents with various threats as if threats will yield money, i tried severally to know if those agents were calling from another planet other than earth, cos i believed everyone on earth knows what is going on has the world is almost completely shut down, they told they are on earth and infact in Lagos, to me that shows the level of wickedness of a company whose only interest is how to recoup their money not even taking into consideration the payment history of the customer. Its extremely sad that at a time every corporate organization is looking for ways to impact the people by means of preaching hope, all that matters to Renmoney is their money. Let me emphasize here that threats doesnt bring about money,compassion does. I will be unfair if i do not single out a particular lady who was exceptionally different ” Ester” she spoke well and kept on encouraging me that things will get better and yes its getting better and i have since began paying, by God’s grace i will soon finish my repayment and i will warn even the worst of my enemy not to near anything that starts with REN……Its been hell of an experience. I will nominate RENMONEY for an award for the company with the most heartless set of customer care team, i am confident that you will surely have no rival for the award.

Source: Trustpilot.com

Yet one customer had this to say:

Currently even having issues with renmoney , they claim you get your credit alert on or before 24hours, it’s just not true, the customer service is just inconsiderate, and some cases ill mannered.. They have no respect for client time, and they just switch off once the loan has been applied for and the payment mandate is placed on your account… Credit doesn’t come within 24hours as they advertise and their interest rates are high..i still have an uncredited loan as we speak, with a payment mandate on my account

Source: Trustpilot.com

Conclusion

Now you know what to expect when applying for a business loan on Renmoney. From Snapshots of loan forms to client reviews, this article provides a step by step guide to loan application and insight on improving your credit score.

Nice post. I was checking constantly this blog and I’m impressed!

Extremely useful info specifically the last part 🙂 I care for such information much.

I was looking for this certain info for a very long time.

Thank you and best of luck. ps4 games 185413490784 ps4

games