Running a business is no child’s play.

Sometimes, being in the moment, you get carried away and lose sight of the big picture – The realities of your business. You forget to keep track of your business metrics and confirm if all is still going as carved out in your professionally written business plan.

While you are busy running your business, you must step back from time to time to evaluate what you are doing in a bid to validate your strategy.

What business metrics are you tracking in your business? Here is a list of key metrics every business should keep track of for growth.

Topics covered in this article:

Turning a small business into a big one is never easy. The statistics are grim. Research suggests that only one-tenth of 1 per cent of companies will ever reach $250 million in annual revenue.

One of the many ways to validate your strategy is to monitor specific business metrics that are essential to the growth of your business.

If you focus on the wrong metrics, you’ll waste time.

Your carefully planned business growth strategies that are often put in place by highly paid business consultants and growth experts will be in futility if you are not monitoring the right metrics.

You can best describe such neglect as ‘vanity metrics’ – metrics that add no real insight into our strategy and growth and may result in a waste of your valuable time and resources in the monitoring of the wrong parameters.

As an entrepreneur, I know how important it is to understand what works on your business and what doesn’t.

Business is unpredictable, and about the only thing that you can count on is that everything continuously changes. You need to measure your business’ performance regularly, so you know what’s successful and what isn’t.

So, how can you understand, manage and measure small business success?

The objective of this post is to highlight some universally relevant metrics that every business, regardless of industry or size, should monitor to stay relevant and profitable.

Contents

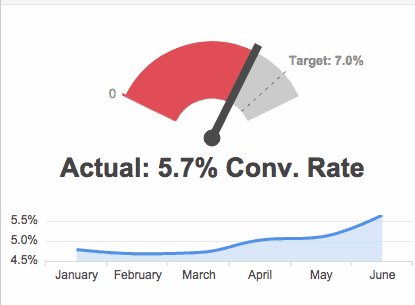

1. Lead-to-Client Conversion Rate

Your marketing is yielding results, and leads are pouring into your sales funnel. However, that is utterly meaningless if a good enough percentage of leads are not subsequently converting to customers. Getting customers in your business is the end game, not some fancy metrics on a social media dashboard.

Your lead-to-client conversion rate is, therefore, one metric that you should never overlook. Tracking your customer conversion rates will provide you with the needed insights required to appraise the effectiveness of your campaign touchpoints as well as your entire sales process.

How you can measure your lead to customer conversion rate?

How do you calculate your lead-to-client conversion rate? You can do this by dividing new leads by the number of new customers. I told you it was simple, didn’t I?

Conversion rates are equal to the total number of conversions divided by the number of leads and then multiplied by 100. So if you had 2000 leads, and 300 of them became new customers, your lead conversion rate is 15%.

Not bad at all!

If You Want to Attain success in your Small Business, Know How To Measure It

How you can improve your lead to customer conversion rate?

If the numbers are lower than what you expected (if you are ambitious enough, they should be), options that are open to you would include optimizing your landing pages and call-to-action (CTA) buttons; and evaluating your sales pipeline to identify where drop-offs are occurring, and or training your salespeople to improve the competence of their sales.

There is always something that you can tweak to improve conversions.

Be careful, however, that you do not tweak too many things at the same time and end up confused about what changes led to what results.

2. Customer Lifetime Value

This metric helps to determine how much revenue your business can reasonably expect from the average customer, over an indefinite period as opposed to just driving value from a single purchase.

The longer a business can retain a paying customer, the higher the lifetime value of that customer would be.

One key reason for measuring this metric is to ensure that the amount spent acquiring new leads does not exceed how much you stand to make over a given period from them should they convert into customers.

For example, how would you react when you discover that the Customer Acquisition Cost is ₦18,000 per customer, and an average customer’s lifetime spend in your business is ₦205,000 – happy?

Pause for a moment. Though the direct cost of providing your service is ₦48,000 you’d still need to account for other indirect costs and allocate a fair share per customer. ?

Additionally, knowing this metric can take you closer to identifying the higher value segments in your business, which will allow you to allocate marketing budget appropriately. If you want to improve retention of your high-value customers, then knowing how to calculate Customer Lifetime Value is not optional for your team.

How to measure Customer Lifetime Value

How you calculate your Customer Lifetime Value may depend on the nature of your products or services.

Are you offering a monthly subscription, or do your customers buy standalone large ticket items? Or, are their purchases structured as multiple repeat transactions spread over months?

One way to measure this metric, which I also consider the way to get the most realistic results, considering some of the factors mentioned above, is:

Multiply the average purchase value by the average frequency of repeat orders. Then multiply that by the average lifespan of a customer in your business to determine your Customer Lifetime Value.

If you find this to be confusing, don’t feel bad.

It took me a while to wrap my head around the math involved in this one. One resource that helped me understand calculating Customer Lifetime Value was this HubSpot article. Check it out. It breaks the math to step-by-step, making it much easier to follow.

You can also download an easy to use CLV calculator on the website.

How to improve customer lifetime value

If the numbers do not make sense, two options would be available to you. The first is that you would need to make changes in your customer acquisition strategies to remain profitable.

- Are you paying too much for qualified leads from your lead sources? Find a way to negotiate it down.

- Are you spending too much on ads that are not well targeted at your ideal prospects? Narrow down your targeting.

- Or, maybe your salespeople are not effective at closing sales? Provide them with adequate training on how to close sales opportunities to improve their conversion rates.

- It could also be that you are not selling enough to the same customers. It is established that it is easier to sell to those who have already bought from you before (provided you delivered to their expectations and above) than to sell to new prospects.

- What can you upsell to your existing customers to make them buy more from your business? A more aggressive tactic here is cross-selling. Immediately after a customer has made payments for a product, offer a related product at a one-time discounted amount if they complete the purchase.

But of all the suggestions to improve Customer Lifetime Value, the most effective would be to keep improving customer retention – Do everything possible to turn your customers to your brand ambassador.

As I pointed out earlier, the longer the customer stays with your business, the more chance you have to earn repeatedly from that single customer.

Hence, a key strategy to improve CLV is getting the customer support and customer experience teams to provide an excellent experience as your customers move along their customer journey.

No matter what you do, if customers do not have a pleasant experience doing business with you, there is no way they are sticking around!

Recall, however, that no one size fits all. Learn what works best with your business and execute appropriately and effectively.

3. Customer Acquisition Cost

The simple information this metric seeks is how much it cost you to get a new customer. It is the cost of convincing a lead to try your product for the first time.

The importance of this cost cannot be over-emphasized, as this metric drives the very profitability of any business. If you find that it consistently costs your business more to acquire customers than you can make back from them, then you have a problem.

On the other hand, if a business manages to reduce the amount of money that they spend to acquire new customers while increasing its customer base, that is an indication of profitability.

To put this in context, let’s use the Oil industry example. When oil is discovered in a new field, oil companies calculate what it would cost to extract it from the field, the volume of oil in the field, and how much the oil would be sold based on current market value to determine if the field is economically viable or not.

In a similar vein, knowing the customer acquisition cost of customers allows the business owner to compare that cost with customer lifetime value to determine if the cost makes business sense. In fact, it is not possible to calculate the lifetime cost of a customer without taking into consideration the Customer Acquisition Cost.

How to measure Customer Acquisition Cost

You can measure your Customer Acquisition Cost by dividing all the costs it took you to acquire new customers by the total number of customers acquired in the same period.

As an example, your business spends ₦30,000 as customer acquisition cost and was able to attract 200 clients. That means that the customer acquisition cost is ₦30,000/200 = ₦150.

It is helpful to be holistic, as a lot of businesses make mistakes here and use a figure that is lower than actual, sabotaging the purpose of the whole exercise. Add together your customer acquisition campaign costs.

How you can improve Customer Acquisition Cost

If you depend on digital channels for your lead acquisition (and you should), a good place to start is in conversion rate optimization.

Are there any discernable friction points that are causing drop-offs along the way? How optimized is your website for mobile? Could you consider automating your sales process, so customers do not need to wait for your salespeople to finish a purchase?

Additionally, collect feedback from your customers and use that to improve and add value to your service in such a way that your customers are certain of the value that they are getting from you and want to stay with you.

It is also a great idea that instead of bundling up all your channels together, you separate them before calculating customer acquisition costs. That way you will know what works, or which channel is too expensive to be sustainable.

However, I will concede that it is more practical for online businesses to apply this aspect, as marketing online is fully attributable, and marketers can say with certainty which campaign resulted in what sale.

4. Customer Loyalty and Retention

While measuring your conversion rate is a big deal, the big picture is in measuring your concession or loyal rate.

If you lose sight of this metric, your efforts at building a business may just end up as a case of pouring water into a leaking basket.

You may be acquiring customers and making sales, but if those customers are not sticking around for the long term, and making repeat purchases from your business, the Customer Lifetime Value will be ridiculously low.

How to calculate the customer retention rate

The first thing you need to calculate customer retention rate is to determine what period you are measuring against.

There are three pieces to this puzzle. To calculate customer retention rate, you need:

- Current number of customers (C)

- Number of new customers added within the period measured (N)

- Number of customers you had at the start of the period (S)

Here is the not so simple way of calculating customer retention rate:

Customer Retention Rate = ((C-N)/S) *100

Not so tough, right?

How you can improve customer retention rate

This simple calculation is the golden rule to building a business that is self-sustainable.

When you consider how expensive it is to acquire new customers and get them to the point where they see value in your relationship, you will learn to value them.

For your business to be considered as growing, your customer acquisition rate must be higher than your customer attrition rate (that is, the rate at which customers leave your business).

This means that for every customer that leaves your business, you will need to find a way to replace that customer, while still acquiring new ones.

Interestingly, and as I have said repeatedly, delivering a superior service that is customer-focused is the number one way to improve your Customer Retention Rate.

According to Gartner, 80% of your future revenue will come from 20% of your customers. That’s a huge figure, and if you are serious about growing your business, that research should be a wakeup call.

Obsess about providing superior value. It will save you money in the long run!

Last Words

Talk to any businessowner out there and they will tell you that they want their business to succeed.

Many, though, are at a loss as to what to measure to ensure that they are making progress on that goal, besides the obvious ones like profit and loss.

While there is some subjectivity to the metrics recommended here, I have taken care to ensure that they are as industry neutral as possible. So just about anybody can pick it up and run with it.

I hope that these suggestions give you a good start on how to measure metrics that add value to the performance of your business.

Wonderful beat ! I would like to apprentice while you amend your website, how can i subscribe

for a blog site? The account helped me a acceptable deal.

I had been a little bit acquainted of this your broadcast provided

bright clear idea games ps4 185413490784 games ps4

I’m not that much of a internet reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back in the future. Many thanks

Hey there just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Internet explorer. I’m not sure if this is a format issue or something to do with internet browser compatibility but I thought I’d post to let you know. The style and design look great though! Hope you get the issue solved soon. Many thanks

I like this site because so much utile stuff on here : D.

I will immediately grab your rss feed as I can not to find your email subscription hyperlink or newsletter service. Do you have any? Kindly allow me know so that I could subscribe. Thanks.

It’s appropriate time to make some plans for the future and it’s time to be happy. I have read this post and if I could I want to suggest you few interesting things or advice. Maybe you can write next articles referring to this article. I desire to read more things about it!

I like examining and I think this website got some really useful stuff on it! .

hello there and thank you to your information – I have definitely picked up anything new from right here. I did alternatively expertise a few technical points the usage of this site, as I skilled to reload the site many times previous to I may just get it to load properly. I have been thinking about if your web hosting is OK? Now not that I’m complaining, but slow loading cases occasions will sometimes have an effect on your placement in google and could harm your high-quality ranking if advertising and ***********|advertising|advertising|advertising and *********** with Adwords. Anyway I am including this RSS to my email and could look out for a lot extra of your respective exciting content. Make sure you update this again soon..

We stumbled over here from a different web page and thought I may as well check things out. I like what I see so i am just following you. Look forward to checking out your web page repeatedly.

This is a topic close to my heart cheers, where are your contact details though?

Well I truly liked studying it. This information provided by you is very helpful for accurate planning.

I’ve read a few excellent stuff here. Definitely price bookmarking for revisiting. I wonder how a lot attempt you set to make one of these wonderful informative site.

This really answered my problem, thank you!

I’m not sure exactly why but this blog is loading extremely slow for me. Is anyone else having this issue or is it a problem on my end? I’ll check back later on and see if the problem still exists.

Absolutely pent subject matter, Really enjoyed looking through.

I’ll right away grab your rss as I can’t find your email subscription link or newsletter service. Do you have any? Please let me know so that I could subscribe. Thanks.

Really informative and wonderful body structure of subject material, now that’s user friendly (:.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

Enjoyed looking at this, very good stuff, appreciate it.

I don’t usually comment but I gotta say regards for the post on this perfect one :D.

My brother suggested I might like this blog. He was totally right. This post truly made my day. You can not imagine simply how much time I had spent for this info! Thanks!

I really treasure your piece of work, Great post.

Hi there! This is my first comment here so I just wanted to give a quick shout out and say I genuinely enjoy reading through your posts. Can you recommend any other blogs/websites/forums that go over the same subjects? Thank you so much!

Very superb info can be found on blog. “I said I didn’t want to run for president. I didn’t ask you to believe me.” by Mario M Cuomo.

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

Good website! I truly love how it is easy on my eyes and the data are well written. I’m wondering how I could be notified when a new post has been made. I’ve subscribed to your RSS which must do the trick! Have a great day!

Very interesting details you have observed, thanks for putting up. “The earth has music for those who listen.” by William Shakespeare.

Definitely believe that which you said. Your favorite reason seemed to be at the internet the simplest thing to keep in mind of. I say to you, I certainly get irked while folks think about worries that they plainly don’t realize about. You managed to hit the nail upon the highest and outlined out the entire thing without having side-effects , folks can take a signal. Will likely be back to get more. Thanks

I do agree with all the ideas you’ve presented in your post. They’re very convincing and will definitely work. Still, the posts are too short for starters. Could you please extend them a bit from next time? Thanks for the post.

I think you have mentioned some very interesting details, appreciate it for the post.

I envy your work, thankyou for all the informative blog posts.

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Howdy would you mind letting me know which webhost you’re working with? I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot quicker then most. Can you recommend a good internet hosting provider at a fair price? Thanks a lot, I appreciate it!

I truly prize your piece of work, Great post.

Hello there, I found your blog by the use of Google while searching for a related matter, your website got here up, it seems great. I’ve bookmarked it in my google bookmarks.

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

I don’t usually comment but I gotta admit appreciate it for the post on this perfect one :D.

Some genuinely nice stuff on this web site, I love it.

Regards for helping out, superb info. “In case of dissension, never dare to judge till you’ve heard the other side.” by Euripides.

It’s really a nice and helpful piece of info. I’m satisfied that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Nice post. I learn something more challenging on different blogs everyday. It will always be stimulating to read content from other writers and practice a little something from their store. I’d prefer to use some with the content on my blog whether you don’t mind. Natually I’ll give you a link on your web blog. Thanks for sharing.

This really answered my problem, thank you!

I love foregathering useful information , this post has got me even more info! .

Perfect piece of work you have done, this web site is really cool with wonderful information.

whoah this blog is great i love reading your articles. Keep up the great work! You know, a lot of people are looking around for this info, you could help them greatly.

Outstanding post however , I was wondering if you could write a litte more on this topic? I’d be very thankful if you could elaborate a little bit further. Kudos!

Great beat ! I would like to apprentice while you amend your website, how could i subscribe for a weblog site? The account aided me a applicable deal. I have been tiny bit familiar of this your broadcast offered vivid clear idea

I know this if off topic but I’m looking into starting my own blog and was wondering what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet smart so I’m not 100 certain. Any suggestions or advice would be greatly appreciated. Thanks

Really good visual appeal on this site, I’d value it 10 10.

I got good info from your blog

There is noticeably a bundle to realize about this. I suppose you made certain nice points in features also.

Hello very nice website!! Guy .. Excellent .. Superb .. I’ll bookmark your blog and take the feeds additionally?KI’m happy to find so many useful information here within the put up, we want develop extra strategies on this regard, thanks for sharing. . . . . .

I’ve recently started a blog, the info you provide on this website has helped me tremendously. Thank you for all of your time & work.

Hello very nice web site!! Guy .. Excellent .. Superb .. I will bookmark your site and take the feeds also…I’m happy to seek out a lot of useful info right here within the publish, we need develop more strategies in this regard, thank you for sharing. . . . . .

Thanks for the sensible critique. Me & my neighbor were just preparing to do some research on this. We got a grab a book from our area library but I think I learned more from this post. I am very glad to see such great info being shared freely out there.

Great line up. We will be linking to this great article on our site. Keep up the good writing.

Only a smiling visitor here to share the love (:, btw great design. “Make the most of your regrets… . To regret deeply is to live afresh.” by Henry David Thoreau.

Hi there, You have done a fantastic job. I’ll definitely digg it and personally recommend to my friends. I am sure they will be benefited from this site.

I’ve been absent for a while, but now I remember why I used to love this blog. Thank you, I’ll try and check back more often. How frequently you update your website?

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade site post from you in the upcoming also. Actually your creative writing abilities has encouraged me to get my own site now. Actually the blogging is spreading its wings rapidly. Your write up is a good example of it.

Some really interesting points you have written.Helped me a lot, just what I was looking for :D.

Some times its a pain in the ass to read what people wrote but this website is real user genial! .

It’s really a cool and useful piece of information. I am glad that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Hey there! I know this is kinda off topic but I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog post or vice-versa? My website discusses a lot of the same topics as yours and I believe we could greatly benefit from each other. If you happen to be interested feel free to shoot me an email. I look forward to hearing from you! Superb blog by the way!

Hi there! Would you mind if I share your blog with my twitter group? There’s a lot of folks that I think would really appreciate your content. Please let me know. Cheers

I am not really wonderful with English but I line up this real easy to read .

Great wordpress blog here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! take care

You have brought up a very great points, thankyou for the post.

I really like your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz answer back as I’m looking to design my own blog and would like to know where u got this from. thanks a lot

Regards for helping out, great info. “A man will fight harder for his interests than for his rights.” by Napoleon Bonaparte.

Hello just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Ie. I’m not sure if this is a format issue or something to do with internet browser compatibility but I thought I’d post to let you know. The design look great though! Hope you get the problem solved soon. Kudos

I am not very wonderful with English but I come up this real easy to translate.

As I web-site possessor I believe the content material here is rattling magnificent , appreciate it for your hard work. You should keep it up forever! Good Luck.

I love examining and I conceive this website got some genuinely utilitarian stuff on it! .

I wanted to type a brief remark in order to say thanks to you for all the precious hints you are giving out at this website. My prolonged internet look up has at the end been paid with sensible information to go over with my classmates and friends. I ‘d suppose that most of us readers are extremely endowed to live in a remarkable website with so many brilliant individuals with very beneficial things. I feel pretty lucky to have discovered the weblog and look forward to some more fun minutes reading here. Thank you once again for everything.

Great line up. We will be linking to this great article on our site. Keep up the good writing.

hello there and thank you for your info – I’ve certainly picked up something new from right here. I did however expertise some technical points using this web site, since I experienced to reload the web site a lot of times previous to I could get it to load properly. I had been wondering if your web host is OK? Not that I am complaining, but slow loading instances times will very frequently affect your placement in google and can damage your high quality score if ads and marketing with Adwords. Well I am adding this RSS to my e-mail and could look out for much more of your respective intriguing content. Ensure that you update this again soon..

Undeniably believe that which you stated. Your favorite reason seemed to be on the net the easiest thing to be aware of. I say to you, I certainly get annoyed while people think about worries that they plainly do not know about. You managed to hit the nail upon the top and defined out the whole thing without having side effect , people could take a signal. Will probably be back to get more. Thanks

As a Newbie, I am continuously exploring online for articles that can be of assistance to me. Thank you

Some genuinely interesting info , well written and loosely user genial.

You should take part in a contest for one of the best blogs on the web. I will recommend this site!

Hi would you mind letting me know which web host you’re utilizing? I’ve loaded your blog in 3 different browsers and I must say this blog loads a lot quicker then most. Can you suggest a good hosting provider at a reasonable price? Kudos, I appreciate it!

fantastic post, very informative. I ponder why the opposite specialists of this sector don’t notice this. You should proceed your writing. I am sure, you have a huge readers’ base already!

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

Hey there! Quick question that’s entirely off topic. Do you know how to make your site mobile friendly? My web site looks weird when viewing from my iphone. I’m trying to find a template or plugin that might be able to resolve this problem. If you have any recommendations, please share. Many thanks!

Simply a smiling visitor here to share the love (:, btw great style and design.

Simply want to say your article is as amazing. The clearness in your post is simply spectacular and i could assume you’re an expert on this subject. Well with your permission let me to grab your feed to keep up to date with forthcoming post. Thanks a million and please carry on the enjoyable work.