The ultimate goal of every small business owner is to grow their beloved business from startup stage to maturity and probably make a Unicorn out of it, worth at least a billion USD.

But like in many other things, the business environment has its many challenges too, ranging from Startup capital to others like cash flow challenges, having the right strategy, marketing plan, and other things as the right staff.

Estimated reading time: 8 minutes

This article takes a critical look at the top 6 common challenges of small business owners, SME entrepreneurs, and how best to mitigate against or solve them.

Most entrepreneurs go into business with a lot of hope and enthusiasm; but, these, with time, are often met by challenges that ultimately make or mar the business. Below is a list of the top 6 challenges that plague most small and medium-sized business owners.

Until you face as much challenge like this, you haven’t faced anything yet… keep moving.

- Startup capital

- Cash flow

- Strategy

- Recruitment and Staff Retention

- Marketing Strategy

- Inadequate Online Presence

Contents

1. Startup Capital:

The challenge: This is by far the most significant challenge faced by almost every single small business owner out there. Fortunately, it is one that most have also solved, else we may not have lots of small businesses out there. However, to fully appreciate the sources of funds available to you as an entrepreneur, you first must understand the fundamental types of entrepreneurship practised.

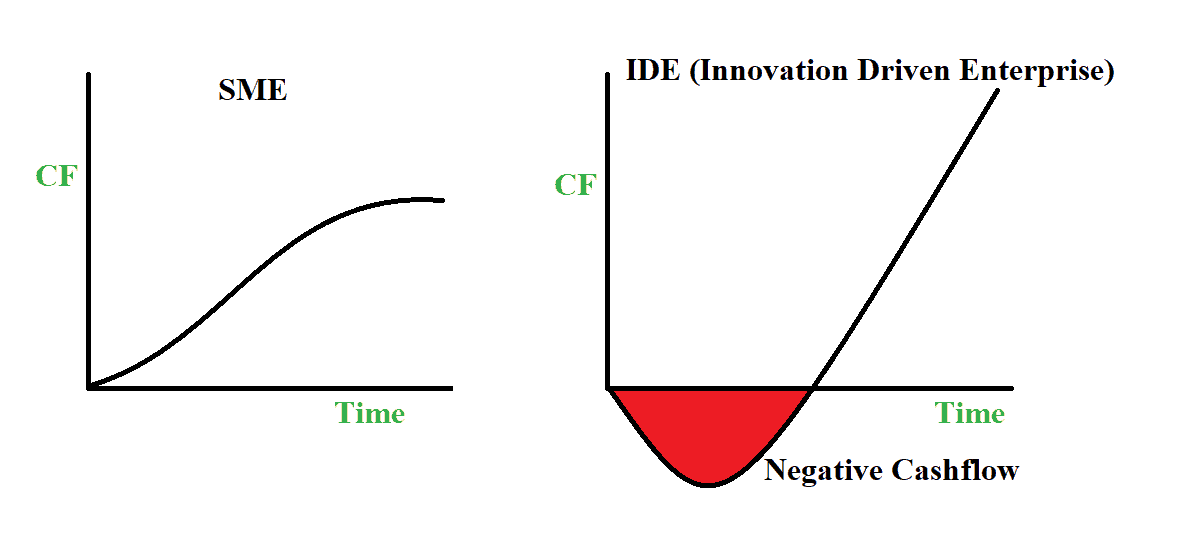

The Solution: The solutions to the funding issues faced by entrepreneurs is embedded in the understanding of entrepreneurship itself. There are fundamentally two types of entrepreneurship – The SME (Small and Medium Enterprise) and the IDE (Innovation Driven Enterprise).

Innovation-driven enterprises (usually large corporations) have access to a large cache of funding sources due to their potentials for a massive return on investments, thus making them magnets for venture capitalists and venture capital firms.

Small and Medium Enterprises, on the other hand, have only a handful of possible sources of funding because they typically do not show a profit for at least some months after startup, if not a few years.

For Small and Medium Business owners, their sources of funding are fundamentally limited to 3 sources, and because each of these sources needs some proof of concept for your planned venture, the amount of money available to you is limited, and most often dependent on your social capital and trust level between the source of fund and the founder(s).

- Angel investors

- Banks and other commerce centric finance houses

- Government

It is therefore of note to say that it is always a good practice to first bootstrap as a small business owner, prove your concept, then move out to secure further funding.

2. Cash Flow Crunch

The challenge: There is no better place where the statement “Cash is king” makes more sense than in running a small business.

Unless your business is backed by some large corporations, deep pocket angel investors, or you had a cache of funds in-store before founding your company, the chances are that you would run into cash flow problems. The flow of cash is to a business, what blood is to humans; without it, we die. Yet many business owners struggle with this challenge.

The embedded video explains a lot about what a cash flow is, and the challenges that lead to a flow crunch.

The Solution: With the explanation given on the significance of maintaining healthy cash flow, it, therefore, means that a business owner must ensure the following:

- Find ways to ensure that the business brings in more money than it expends

- Ensure that the company adequately manages such funds

- Ensure proper budgeting and cashflow forecasting

- Find ways to develop creditworthiness with your supplies and operate on credits as much as possible

- Open a line of credit with your bankers

- Ensure that as a business owner, do not forget about yourself when planning for your business’s financial future

If you lack the necessary know-how to manage money, find someone who does.

ExpertsNG

A crucial point to keep in mind is that you don’t just need money for your business —you must have a plan to manage such money. Do not acquire a loan or spend your own savings without knowing exactly where money needs to be spent, how the return on your investment would be made, and how long it would take.

3. Strategy

The challenge: Strategy is one important aspect of running a business that most small business owners shy away from. Actually, most small business owners know little to nothing in terms of strategy.

A strategy is a long-term plan that you create for your company to reach the desired, future state you envision. A strategy includes your company’s goals and objectives, the type of products/services that you plan to build, the customers to who you want to sell to and the markets that you serve to make profits. Source: Forbes.com

The Solution: For a new entrant SME to succeed in its chosen market, it must create and execute a sound strategy that puts into consideration a lot of variables, especially factors as explained by Porter’s five forces.

At this stage, it is better to call in the experts than try to play smart and be penny wise but pound foolish. This is not the time for experimentation. It is, instead, the time to set standards and baselines that work.

You need to revisit your mission and vision statements, break them into SMART goals, and get them aligned with your capabilities and realities. After all, what’s a vision statement if you do not align it with your realities.

Once you set your baselines with the right documentation and processes in place, your business would be better placed, and most likely be on a trajectory for success.

4. Recruitment and Staff Retention

The Challenge: Hire Slow Fire Fast is a common word in entrepreneurship. There are, however, a ton of problems associated with those words. From the fear of leaked company secrets to the need to keep off the bad conversations involved with firing an underperforming employer, most business owners struggle with recruitment and staff retention issues.

According to HBR – Many startups hire fast and fire slow. A bias for speed combined with the pressure for high growth drives many leaders to be quick to hire (“We need to fill this role now!”) but slow to remove underperforming employees. To “hire slow, fire fast,” start by being absurdly selective in whom you hire.

Did you know that it is not the prospective candidates that dread job interviews the most? — it’s entrepreneurs, the business owners.

The Solution: Get it right from your foundation. Even if you did not get it right earlier, it is not too late to get things right. Functional staff is needed for business growth.

You must get an HR unit in place and set the right policies to guide you with your recruitment and staff retention issues.

To get things right, please follow these steps:

- Build a culture: Ask yourself what you want your organization to be known for in terms of its processes and how things get done. Then write it down and envision the people you would want to work for you. Note: The first thing to check while hiring your staff is their attitude. Trust me, nothing positive comes out of anything negative.

- Create Organizational Structure: I believe that by now, you must have listed the skills that you need to make up your team. Now sit down and write what you expect of each role in terms of skills and daily work expectations.

- Create A Staffing Plan: Note that the employee does not define the role; the role defines the employee. It is, therefore, profound that you identify the roles you want, when you want the roles filled, and the skills you would need on your roles.

- Get Essential HR Documents and Forms: It is very important that you get the essential HR documents like the under-listed:

- Employee handbook

- Employee job description

- Process manuals

- Performance Appraisal documents

- Staff onboarding documents

- Employee Management & Recordkeeping documents, etc.

5. Marketing strategy

The challenge: Most SME type business owners do not have the right marketing skills, yet they hardly have the pockets deep enough to hire top-notch in-house marketing experts.

The solution: It is always a good idea to outsource the marketing strategy of a small business to experts. The challenge most times is that experts generally are mostly perceived as very expensive. The truth, however, is that what you need at this point in your business is a core marketing plan: a document to outline what marketing activities you will undertake to motivate purchases.

It is not the time to experiment. Give the expert a budget to work with; there are always experts out there that fits your budget, find them.

6. Inadequate Online Presence

These days, online is the current offline. No marketing strategy is complete without a significant level of a ubiquitous online presence. A significant percentage of your marketing and sales campaigns must be done online.

Regardless of a company’s size or the size of its business, customer acquisition is at the centre of it all, and these days, there is no better place to engage with customers than the many online platforms where they now congregate for diverse reasons.

The challenge: The online space is filled with noise. As a business owner, it has become difficult to get your messages through the noise and reach your prospective customers.

The solution: Your online presence as an individual, a brand, or business, is crucial to your outbound marketing campaigns as it reinforces your brand and what you offer to your target market.

When it comes to online marketing, Consistency = Engagement, and Engagement = Brand awareness.

RELATED ARTICLES

To add to it

1-steadfastness

2-deligence

3-be prayerfully and the consistent with whatever business you chose.

Don’t give up or stop because of little distractions

Bustyasianbabes is a great arousing collection of most hardcore sexy

https://compilation-amateur-porn.fetish-matters.net/?crystal-maliyah

I carry on listening to the rumor lecture about getting boundless online grant applications so I have been looking around for the best site to get one. Could you advise me please, where could i acquire some?

F*ckin¦ amazing issues here. I¦m very satisfied to see your article. Thanks a lot and i’m having a look ahead to contact you. Will you kindly drop me a mail?

Hey! Someone in my Myspace group shared this website with us so I came to give it a look. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Wonderful blog and brilliant design and style.

F*ckin’ remarkable issues here. I am very happy to see your post. Thanks so much and i’m looking ahead to touch you. Will you please drop me a mail?

fabuloso este conteúdo. Gostei muito. Aproveitem e vejam este conteúdo. informações, novidades e muito mais. Não deixem de acessar para se informar mais. Obrigado a todos e até a próxima. 🙂

You need to take part in a contest for among the best blogs on the web. I’ll recommend this website!

I think this is among the most important info for me. And i’m glad reading your article. But want to remark on few general things, The site style is perfect, the articles is really nice : D. Good job, cheers

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

I cherished as much as you’ll obtain performed right here. The caricature is tasteful, your authored subject matter stylish. nonetheless, you command get got an shakiness over that you would like be handing over the following. ill without a doubt come further before again since precisely the similar just about very continuously inside case you shield this hike.

I was just seeking this info for some time. After 6 hours of continuous Googleing, finally I got it in your website. I wonder what’s the lack of Google strategy that do not rank this type of informative websites in top of the list. Normally the top web sites are full of garbage.

I got what you intend, thankyou for putting up.Woh I am pleased to find this website through google.

Well I definitely enjoyed studying it. This post provided by you is very practical for accurate planning.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You obviously know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

Yesterday, while I was at work, my sister stole my iPad and tested to see if it can survive a thirty foot drop, just so she can be a youtube sensation. My apple ipad is now destroyed and she has 83 views. I know this is entirely off topic but I had to share it with someone!

Hi my friend! I want to say that this post is amazing, nice written and include approximately all important infos. I’d like to see more posts like this.

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

I have been exploring for a bit for any high quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this website. Reading this info So i’m happy to convey that I have a very good uncanny feeling I discovered just what I needed. I most certainly will make certain to don’t forget this site and give it a look regularly.

I have been browsing on-line more than three hours nowadays, but I by no means found any fascinating article like yours. It?¦s pretty value enough for me. In my opinion, if all site owners and bloggers made just right content material as you did, the internet shall be a lot more useful than ever before.

I would like to thank you for the efforts you have put in writing this site. I am hoping the same high-grade web site post from you in the upcoming also. Actually your creative writing skills has encouraged me to get my own site now. Actually the blogging is spreading its wings quickly. Your write up is a good example of it.

I’ve been surfing online greater than 3 hours lately, yet I by no means found any interesting article like yours. It is pretty value enough for me. In my view, if all website owners and bloggers made just right content as you did, the internet might be much more useful than ever before. “No one has the right to destroy another person’s belief by demanding empirical evidence.” by Ann Landers.

Its like you read my thoughts! You appear to know a lot approximately this, such as you wrote the guide in it or something. I feel that you simply can do with some percent to force the message home a little bit, but instead of that, this is great blog. A fantastic read. I will certainly be back.

I’ve learn several good stuff here. Certainly value bookmarking for revisiting. I wonder how much attempt you place to make this type of wonderful informative web site.

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

I appreciate, cause I found just what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a nice day. Bye

Aw, this was a really nice post. In idea I would like to put in writing like this moreover – taking time and actual effort to make a very good article… however what can I say… I procrastinate alot and under no circumstances appear to get one thing done.

Thanks on your marvelous posting! I quite enjoyed reading it, you could be a great author.I will always bookmark your blog and definitely will come back down the road. I want to encourage continue your great work, have a nice holiday weekend!

Hey There. I discovered your blog the use of msn. That is a very neatly written article. I’ll be sure to bookmark it and come back to learn more of your helpful information. Thanks for the post. I’ll certainly comeback.

Magnificent beat ! I would like to apprentice while you amend your site, how can i subscribe for a blog website? The account helped me a appropriate deal. I were tiny bit familiar of this your broadcast offered brilliant transparent idea

Keep up the superb piece of work, I read few content on this web site and I believe that your site is really interesting and has got bands of superb info .

NuStarGame refers to a digital entertainment platform designed to provide users with an organized and accessible online experience. The platform focuses on clean interface design, smooth navigation, and compatibility across multiple devices, making it suitable for users looking for a structured digital environment.

Hi my family member! I wish to say that this post is amazing, great written and come with almost all significant infos. I’d like to see extra posts like this .

Great post, you have pointed out some wonderful points, I also conceive this s a very fantastic website.

It?¦s actually a nice and useful piece of information. I am glad that you simply shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

I have read several good stuff here. Certainly value bookmarking for revisiting. I wonder how a lot effort you put to make this sort of excellent informative site.

Heya i am for the first time here. I came across this board and I in finding It really useful & it helped me out a lot. I hope to give one thing again and aid others like you aided me.

I do like the way you have framed this specific problem plus it does provide me personally some fodder for consideration. However, because of what precisely I have seen, I simply hope when the actual feed-back pile on that individuals continue to be on issue and in no way get started on a tirade of some other news of the day. Anyway, thank you for this outstanding piece and even though I can not necessarily agree with the idea in totality, I value the standpoint.

Hi my friend! I want to say that this post is awesome, nice written and include approximately all vital infos. I would like to see more posts like this.

Thanks for any other informative site. The place else may just I get that type of info written in such a perfect means? I’ve a project that I’m simply now operating on, and I’ve been on the glance out for such information.

But a smiling visitor here to share the love (:, btw outstanding design.

Hi my family member! I wish to say that this article is awesome, nice written and come with almost all significant infos. I?¦d like to peer extra posts like this .

I think other website proprietors should take this internet site as an model, very clean and great user pleasant pattern.

I like this website because so much useful stuff on here : D.

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.

F*ckin¦ remarkable things here. I am very happy to see your post. Thanks so much and i’m having a look ahead to contact you. Will you kindly drop me a mail?

Undeniably imagine that that you said. Your favourite justification appeared to be on the internet the easiest thing to take note of. I say to you, I definitely get annoyed whilst other people consider concerns that they just do not understand about. You managed to hit the nail upon the top and also defined out the whole thing without having side-effects , folks could take a signal. Will likely be back to get more. Thanks

Hello, you used to write magnificent, but the last several posts have been kinda boring… I miss your great writings. Past few posts are just a little bit out of track! come on!

I¦ll immediately take hold of your rss feed as I can’t in finding your e-mail subscription link or e-newsletter service. Do you have any? Kindly let me recognize in order that I could subscribe. Thanks.

naturally like your web-site but you have to check the spelling on quite a few of your posts. A number of them are rife with spelling problems and I find it very troublesome to tell the truth nevertheless I’ll certainly come back again.

Wow that was odd. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say fantastic blog!

I’m impressed, I need to say. Really hardly ever do I encounter a weblog that’s both educative and entertaining, and let me tell you, you’ve hit the nail on the head. Your idea is outstanding; the issue is one thing that not enough individuals are speaking intelligently about. I’m very pleased that I stumbled across this in my seek for one thing regarding this.

fantastic publish, very informative. I’m wondering why the opposite experts of this sector do not realize this. You should continue your writing. I’m confident, you’ve a great readers’ base already!

you’re really a excellent webmaster. The site loading velocity is incredible. It kind of feels that you’re doing any distinctive trick. In addition, The contents are masterwork. you have done a fantastic task on this matter!

hello!,I really like your writing very a lot! percentage we keep in touch more approximately your article on AOL? I need a specialist on this space to solve my problem. Maybe that’s you! Taking a look forward to see you.

Respect to op, some superb entropy.

I appreciate, cause I found just what I was looking for. You have ended my 4 day long hunt! God Bless you man. Have a great day. Bye

you have a great blog here! would you like to make some invite posts on my blog?

Loving the information on this site, you have done great job on the posts.

Perfectly composed subject material, regards for information. “In the fight between you and the world, back the world.” by Frank Zappa.

I like examining and I believe this website got some truly useful stuff on it! .

Hi there are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and set up my own. Do you require any html coding expertise to make your own blog? Any help would be really appreciated!

I always was interested in this subject and stock still am, thankyou for posting.

Whats Taking place i’m new to this, I stumbled upon this I have found It absolutely useful and it has helped me out loads. I am hoping to contribute & aid other users like its helped me. Good job.

Wow! This blog looks just like my old one! It’s on a totally different topic but it has pretty much the same layout and design. Wonderful choice of colors!

Great post but I was wondering if you could write a litte more on this topic? I’d be very thankful if you could elaborate a little bit more. Thank you!

Thanks, I’ve recently been searching for information approximately this subject for a long time and yours is the best I’ve found out till now. However, what about the conclusion? Are you sure about the supply?

You are my intake, I possess few blogs and often run out from to brand.

Sweet internet site, super design and style, very clean and utilise pleasant.

Hey there this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding knowledge so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

You completed some good points there. I did a search on the subject matter and found the majority of persons will go along with with your blog.

I believe this web site holds some really excellent info for everyone : D.

Just desire to say your article is as amazing. The clearness in your post is just spectacular and i could assume you are an expert on this subject. Fine with your permission allow me to grab your feed to keep up to date with forthcoming post. Thanks a million and please carry on the rewarding work.

Very interesting topic, thanks for putting up.

We’re a group of volunteers and opening a new scheme in our community. Your site provided us with helpful info to work on. You have performed a formidable job and our whole community shall be grateful to you.

Attractive component to content. I simply stumbled upon your website and in accession capital to assert that I acquire in fact loved account your blog posts. Anyway I will be subscribing in your augment and even I fulfillment you access persistently fast.

Very interesting details you have mentioned, appreciate it for putting up. “‘Tis an ill wind that blows no minds.” by Malaclypse the Younger.

Hi there are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and create my own. Do you require any coding expertise to make your own blog? Any help would be greatly appreciated!

bingoplus is a commonly used keyword variant referring to the Bingo Plus platform and its related services.

I appreciate, cause I found just what I was looking for. You’ve ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

I keep listening to the reports lecture about receiving boundless online grant applications so I have been looking around for the finest site to get one. Could you advise me please, where could i find some?

Very interesting subject , thankyou for putting up.

Would you be eager about exchanging hyperlinks?

Hi this is kinda of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding know-how so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

This actually answered my downside, thanks!

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

Very interesting subject, regards for posting.

Very nice post. I just stumbled upon your weblog and wished to mention that I have really loved browsing your blog posts. In any case I will be subscribing on your feed and I am hoping you write once more very soon!

Excellent read, I just passed this onto a colleague who was doing some research on that. And he just bought me lunch as I found it for him smile Thus let me rephrase that: Thanks for lunch! “To be 70 years young is sometimes far more cheerful and hopeful than to be 40 years old.” by Oliver Wendell Holmes.

Just wish to say your article is as astounding. The clearness in your post is just spectacular and i can assume you are an expert on this subject. Fine with your permission let me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please continue the rewarding work.

Hello, i think that i saw you visited my web site so i came to “return the favor”.I am trying to find things to enhance my web site!I suppose its ok to use a few of your ideas!!

Cool blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple tweeks would really make my blog shine. Please let me know where you got your design. Appreciate it

You really make it seem so easy along with your presentation however I to find this topic to be actually one thing that I believe I would by no means understand. It kind of feels too complex and extremely broad for me. I am taking a look forward for your subsequent submit, I will attempt to get the hold of it!

Regards for helping out, fantastic information. “I have witnessed the softening of the hardest of hearts by a simple smile.” by Goldie Hawn.

I?¦ve recently started a web site, the info you offer on this site has helped me tremendously. Thank you for all of your time & work.

Great line up. We will be linking to this great article on our site. Keep up the good writing.

F*ckin’ remarkable things here. I’m very glad to look your post. Thanks a lot and i’m having a look ahead to contact you. Will you kindly drop me a mail?

What i don’t realize is actually how you are now not really much more smartly-favored than you may be now. You are very intelligent. You know therefore significantly in relation to this topic, made me in my opinion imagine it from numerous various angles. Its like women and men are not interested except it is something to accomplish with Woman gaga! Your personal stuffs outstanding. All the time care for it up!

Hi there, I found your blog via Google while looking for a related topic, your site came up, it looks good. I have bookmarked it in my google bookmarks.

This site is my inspiration , very good design and perfect content.

I simply wished to thank you very much all over again. I am not sure the things that I would have handled in the absence of the actual creative ideas documented by you about such a subject. It was actually a real difficult difficulty for me, nevertheless spending time with the well-written tactic you handled it forced me to leap over gladness. I am just grateful for this work and in addition believe you find out what a great job that you’re putting in training people today via your web blog. Probably you have never encountered any of us.

I appreciate, cause I found exactly what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a nice day. Bye

My wife and i got so thankful that Jordan managed to deal with his research by way of the precious recommendations he acquired using your web page. It is now and again perplexing to just continually be making a gift of tips and tricks which usually most people might have been trying to sell. And we keep in mind we need you to be grateful to because of that. Those explanations you have made, the straightforward site navigation, the relationships you will help to create – it’s got everything impressive, and it’s really making our son in addition to our family reckon that the subject is awesome, which is unbelievably indispensable. Thank you for the whole thing!

I’m impressed, I have to say. Actually hardly ever do I encounter a blog that’s each educative and entertaining, and let me inform you, you’ve gotten hit the nail on the head. Your concept is excellent; the issue is something that not enough people are speaking intelligently about. I am very blissful that I stumbled throughout this in my seek for one thing referring to this.

whoah this blog is wonderful i love reading your posts. Keep up the good work! You know, a lot of people are searching around for this information, you can aid them greatly.

I loved as much as you will receive carried out right here. The sketch is attractive, your authored subject matter stylish. nonetheless, you command get got an impatience over that you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly very often inside case you shield this increase.

You could definitely see your skills in the work you write. The world hopes for more passionate writers like you who are not afraid to say how they believe. Always follow your heart.

I like this site so much, bookmarked.

Attractive part of content. I simply stumbled upon your blog and in accession capital to assert that I acquire actually enjoyed account your blog posts. Anyway I’ll be subscribing for your augment and even I achievement you get entry to constantly rapidly.

Hiya, I’m really glad I’ve found this info. Nowadays bloggers publish only about gossips and internet and this is really frustrating. A good site with interesting content, this is what I need. Thank you for keeping this web-site, I will be visiting it. Do you do newsletters? Can not find it.

It is really a nice and useful piece of info. I’m glad that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

I’d should check with you here. Which is not something I usually do! I enjoy reading a publish that may make individuals think. Also, thanks for allowing me to comment!

Very efficiently written article. It will be valuable to anybody who usess it, including me. Keep doing what you are doing – i will definitely read more posts.

Whats up very cool website!! Man .. Excellent .. Wonderful .. I’ll bookmark your site and take the feeds alsoKI’m satisfied to seek out a lot of useful info right here in the submit, we want work out more techniques on this regard, thanks for sharing. . . . . .

Hi there! I just wish to give an enormous thumbs up for the good info you could have here on this post. I shall be coming again to your blog for extra soon.

Just desire to say your article is as astounding. The clarity on your post is just great and that i can think you are an expert in this subject. Well along with your permission let me to seize your feed to keep up to date with forthcoming post. Thank you 1,000,000 and please keep up the gratifying work.

I really wanted to write down a quick word to be able to appreciate you for these lovely secrets you are showing at this website. My particularly long internet lookup has at the end of the day been compensated with excellent details to talk about with my two friends. I ‘d assume that most of us readers actually are unquestionably lucky to be in a fabulous website with many marvellous people with useful concepts. I feel truly fortunate to have come across the site and look forward to really more fun moments reading here. Thanks a lot once more for everything.

Howdy just wanted to give you a brief heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same outcome.

I reckon something really special in this site.

Very interesting subject, thank you for posting.

Normally I don’t read article on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thanks, very nice post.

My spouse and I stumbled over here different web page and thought I should check things out. I like what I see so now i am following you. Look forward to exploring your web page again.

Hello this is kinda of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding skills so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

Oh my goodness! an incredible article dude. Thanks Nonetheless I am experiencing difficulty with ur rss . Don’t know why Unable to subscribe to it. Is there anyone getting equivalent rss downside? Anyone who knows kindly respond. Thnkx

Hello, you used to write excellent, but the last several posts have been kinda boring?K I miss your super writings. Past few posts are just a little bit out of track! come on!

Real nice pattern and excellent written content, hardly anything else we need :D.

It’s a shame you don’t have a donate button! I’d most certainly donate to this superb blog! I guess for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to brand new updates and will share this website with my Facebook group. Talk soon!

It’s really a great and helpful piece of info. I’m glad that you just shared this useful info with us. Please keep us informed like this. Thanks for sharing.

I’m typically to blogging and i actually recognize your content. The article has actually peaks my interest. I’m going to bookmark your web site and keep checking for brand new information.

Enjoyed reading this, very good stuff, thanks. “Golf isn’t a game, it’s a choice that one makes with one’s life.” by Charles Rosin.

Hi just wanted to give you a brief heads up and let you know a few of the images aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same results.

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

Thank you for another informative blog. Where else may just I get that kind of info written in such an ideal means? I have a undertaking that I am just now operating on, and I have been at the glance out for such information.

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

Hello! This is my first comment here so I just wanted to give a quick shout out and tell you I genuinely enjoy reading your posts. Can you recommend any other blogs/websites/forums that go over the same subjects? Thank you!

I like what you guys are up also. Such intelligent work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂

Nice post. I be taught something more difficult on completely different blogs everyday. It should at all times be stimulating to read content from different writers and apply just a little one thing from their store. I’d prefer to use some with the content material on my weblog whether or not you don’t mind. Natually I’ll provide you with a hyperlink in your net blog. Thanks for sharing.

I used to be very pleased to find this net-site.I needed to thanks in your time for this glorious learn!! I positively enjoying each little little bit of it and I’ve you bookmarked to take a look at new stuff you blog post.

naturally like your web-site but you need to check the spelling on several of your posts. Many of them are rife with spelling problems and I find it very troublesome to tell the truth nevertheless I’ll certainly come back again.

This actually answered my drawback, thanks!

Unquestionably imagine that which you said. Your favourite reason appeared to be at the internet the simplest factor to keep in mind of. I say to you, I certainly get annoyed even as folks think about issues that they plainly do not understand about. You managed to hit the nail upon the highest and also defined out the entire thing with no need side-effects , other folks could take a signal. Will probably be back to get more. Thanks

Some times its a pain in the ass to read what people wrote but this site is real user friendly! .

Hi there, You have performed an excellent job. I’ll certainly digg it and for my part recommend to my friends. I am sure they will be benefited from this site.

I think this internet site holds some very wonderful information for everyone :D.

You actually make it appear really easy with your presentation however I find this topic to be really one thing which I feel I’d never understand. It sort of feels too complex and very huge for me. I’m taking a look forward in your next post, I’ll attempt to get the hang of it!

I think this is one of the most significant information for me. And i am glad reading your article. But should remark on few general things, The web site style is wonderful, the articles is really excellent :D. Good job, cheers

Appreciate it for helping out, great information. “Nobody can be exactly like me. Sometimes even I have trouble doing it.” by Tallulah Bankhead.

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.

Hi my loved one! I wish to say that this post is amazing, nice written and come with almost all important infos. I’d like to see extra posts like this.

Hi! I know this is kinda off topic however I’d figured I’d ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa? My website goes over a lot of the same topics as yours and I feel we could greatly benefit from each other. If you’re interested feel free to shoot me an e-mail. I look forward to hearing from you! Terrific blog by the way!

Super-Duper blog! I am loving it!! Will come back again. I am taking your feeds also.

Hi there! I simply wish to give a huge thumbs up for the good info you’ve got here on this post. I might be coming back to your blog for more soon.

I’m very happy to read this. This is the kind of manual that needs to be given and not the accidental misinformation that is at the other blogs. Appreciate your sharing this greatest doc.

I like this web blog very much, Its a really nice situation to read and obtain info . “Philosophy is a battle against the bewitchment of our intelligence by means of language.” by Ludwig Wittgenstein.

you are really a good webmaster. The website loading speed is amazing. It seems that you are doing any unique trick. Moreover, The contents are masterpiece. you’ve done a great job on this topic!

Hi, I think your site might be having browser compatibility issues. When I look at your blog site in Firefox, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, awesome blog!

Some truly choice blog posts on this web site, bookmarked.

I’ve been surfing online more than 3 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all website owners and bloggers made good content as you did, the internet will be much more useful than ever before.

It’s onerous to seek out knowledgeable individuals on this subject, however you sound like you recognize what you’re talking about! Thanks

I truly enjoy reading on this web site, it has superb blog posts. “A short saying oft contains much wisdom.” by Sophocles.

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks

Glad to be one of the visitants on this awe inspiring site : D.

I like this internet site because so much utile stuff on here :D.

Precisely what I was searching for, appreciate it for putting up.

You can definitely see your enthusiasm in the work you write. The arena hopes for even more passionate writers such as you who are not afraid to mention how they believe. All the time go after your heart. “What power has law where only money rules.” by Gaius Petronius.

I regard something truly interesting about your website so I saved to fav.

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a bit, but other than that, this is excellent blog. A great read. I’ll certainly be back.

What i do not realize is actually how you’re no longer really a lot more neatly-appreciated than you may be right now. You are very intelligent. You understand therefore significantly when it comes to this subject, made me personally imagine it from so many varied angles. Its like men and women don’t seem to be involved unless it is something to do with Woman gaga! Your personal stuffs nice. All the time care for it up!

Real excellent info can be found on web site. “It is fast approaching the point where I don’t want to elect anyone stupid enough to want the job.” by Erma Bombeck.

Thanks for another great article. Where else may anyone get that kind of information in such an ideal approach of writing? I’ve a presentation subsequent week, and I am at the look for such info.

I must express my appreciation for your generosity supporting folks that should have help on this one field. Your real commitment to passing the message around has been incredibly significant and have usually encouraged others much like me to get to their targets. Your entire valuable guideline indicates a whole lot a person like me and somewhat more to my colleagues. Thanks a ton; from everyone of us.

Exceptional post however I was wanting to know if you could write a litte more on this subject? I’d be very grateful if you could elaborate a little bit further. Appreciate it!

Thank you for sharing with us, I think this website really stands out :D.

Thanks, I have recently been searching for information approximately this topic for ages and yours is the best I’ve found out so far. However, what concerning the conclusion? Are you certain in regards to the source?

Hi there, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam remarks? If so how do you reduce it, any plugin or anything you can advise? I get so much lately it’s driving me crazy so any assistance is very much appreciated.

As a Newbie, I am constantly exploring online for articles that can aid me. Thank you

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

Super-Duper site! I am loving it!! Will come back again. I am bookmarking your feeds also

I dugg some of you post as I cerebrated they were very helpful invaluable

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You obviously know what youre talking about, why waste your intelligence on just posting videos to your weblog when you could be giving us something enlightening to read?

Hi, i think that i saw you visited my blog thus i got here to “go back the prefer”.I’m trying to in finding issues to enhance my site!I suppose its good enough to make use of a few of your ideas!!

You can definitely see your skills in the work you write. The world hopes for more passionate writers like you who are not afraid to say how they believe. Always follow your heart.

Great post, I think website owners should learn a lot from this site its really user pleasant.

Hello there, simply become alert to your blog through Google, and located that it’s really informative. I’m gonna watch out for brussels. I’ll be grateful if you happen to proceed this in future. Numerous people will be benefited from your writing. Cheers!

What i don’t understood is actually how you are not really a lot more neatly-liked than you might be now. You are so intelligent. You know thus considerably in the case of this matter, produced me personally imagine it from so many various angles. Its like women and men don’t seem to be involved until it is one thing to accomplish with Girl gaga! Your own stuffs nice. All the time care for it up!

Some genuinely fantastic articles on this site, regards for contribution. “It is not often that someone comes along who is a true friend and a good writer.” by E. B. White.

Its such as you read my mind! You seem to grasp so much about this, like you wrote the ebook in it or something. I believe that you simply could do with a few p.c. to power the message house a bit, however instead of that, that is excellent blog. An excellent read. I’ll definitely be back.

You made some good points there. I looked on the internet for the issue and found most guys will agree with your blog.

hi!,I like your writing very much! share we communicate more about your article on AOL? I need an expert on this area to solve my problem. May be that’s you! Looking forward to see you.

I have read several excellent stuff here. Certainly price bookmarking for revisiting. I surprise how so much effort you place to make this kind of fantastic informative site.

I’m really loving the theme/design of your site. Do you ever run into any web browser compatibility problems? A number of my blog readers have complained about my site not working correctly in Explorer but looks great in Opera. Do you have any recommendations to help fix this problem?

I have fun with, lead to I found just what I used to be having a look for. You’ve ended my four day long hunt! God Bless you man. Have a nice day. Bye

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

I think this is one of the most important info for me. And i’m glad reading your article. But should remark on some general things, The website style is ideal, the articles is really nice :D. Good job, cheers

My brother suggested I might like this web site. He was entirely right. This post actually made my day. You cann’t imagine just how much time I had spent for this info! Thanks!

This really answered my downside, thank you!

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your wonderful post. Also, I have shared your website in my social networks!

I really like your writing style, superb information, appreciate it for putting up :D.

Very interesting topic, appreciate it for putting up.

I consider something really special in this web site.

I dugg some of you post as I cogitated they were invaluable extremely helpful

Wow! Thank you! I always needed to write on my website something like that. Can I include a portion of your post to my website?

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.

You have observed very interesting points! ps nice internet site. “Hares can gamble over the body of a dead lion.” by Publilius Syrus.

It’s really a nice and useful piece of information. I’m satisfied that you just shared this useful information with us. Please stay us informed like this. Thanks for sharing.

I not to mention my friends were going through the nice advice from your web site and then at once developed a terrible suspicion I had not thanked the web blog owner for those tips. The people ended up so thrilled to learn them and have in effect extremely been using them. Many thanks for really being considerably helpful and then for pick out this form of smart areas most people are really desperate to be aware of. My sincere apologies for not saying thanks to you earlier.

I’ve been surfing online more than 3 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my view, if all webmasters and bloggers made good content as you did, the web will be a lot more useful than ever before.

I really like your writing style, excellent info, appreciate it for putting up :D. “Silence is more musical than any song.” by Christina G. Rossetti.

Outstanding post, you have pointed out some fantastic details , I also conceive this s a very fantastic website.

Oh my goodness! an incredible article dude. Thanks Nonetheless I am experiencing issue with ur rss . Don’t know why Unable to subscribe to it. Is there anyone getting equivalent rss drawback? Anyone who knows kindly respond. Thnkx

You have observed very interesting points! ps decent internet site.

I’ve been surfing online more than three hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all webmasters and bloggers made good content as you did, the internet will be a lot more useful than ever before.

Utterly pent subject material, appreciate it for information. “Necessity is the mother of taking chances.” by Mark Twain.

I truly appreciate this post. I’ve been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again!

Some really nice and utilitarian information on this internet site, also I think the style and design has got wonderful features.

Merely a smiling visitor here to share the love (:, btw great design. “Make the most of your regrets… . To regret deeply is to live afresh.” by Henry David Thoreau.

Amazing blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple tweeks would really make my blog stand out. Please let me know where you got your design. Appreciate it

I simply could not depart your web site before suggesting that I really loved the usual information a person supply in your visitors? Is gonna be again often in order to inspect new posts.

You could definitely see your skills within the paintings you write. The world hopes for more passionate writers like you who aren’t afraid to mention how they believe. Always go after your heart. “Experience is a good school, but the fees are high.” by Heinrich Heine.

I do agree with all the ideas you have presented in your post. They’re really convincing and will certainly work. Still, the posts are too short for newbies. Could you please extend them a bit from next time? Thanks for the post.

Great write-up, I’m regular visitor of one’s site, maintain up the excellent operate, and It is going to be a regular visitor for a lengthy time.

I’ll immediately take hold of your rss as I can not find your email subscription link or e-newsletter service. Do you have any? Please allow me recognize so that I may just subscribe. Thanks.

I conceive this web site has got some real fantastic info for everyone. “The penalty of success is to be bored by the attentions of people who formerly snubbed you.” by Mary Wilson Little.

Its great as your other articles : D, regards for putting up. “So, rather than appear foolish afterward, I renounce seeming clever now.” by William of Baskerville.

Hi my family member! I wish to say that this post is awesome, nice written and include almost all vital infos. I would like to look extra posts like this .

Nice post. I learn something more challenging on totally different blogs everyday. It should at all times be stimulating to read content from different writers and apply a little one thing from their store. I’d favor to use some with the content material on my blog whether or not you don’t mind. Natually I’ll give you a hyperlink on your internet blog. Thanks for sharing.

Woh I like your blog posts, saved to my bookmarks! .

Hiya very cool blog!! Guy .. Excellent .. Wonderful .. I will bookmark your blog and take the feeds also?KI’m satisfied to search out so many useful info right here within the post, we’d like work out extra strategies on this regard, thanks for sharing. . . . . .

Its like you read my mind! You appear to understand so much approximately this, like you wrote the e book in it or something. I think that you can do with some to power the message home a little bit, but instead of that, that is magnificent blog. A great read. I will certainly be back.

It’s actually a cool and useful piece of information. I’m glad that you simply shared this useful info with us. Please stay us up to date like this. Thanks for sharing.

You got a very good website, Gladiolus I discovered it through yahoo.

Youre so cool! I dont suppose Ive learn something like this before. So nice to find anyone with some original ideas on this subject. realy thanks for starting this up. this website is something that’s wanted on the internet, somebody with slightly originality. helpful job for bringing something new to the web!

It is in reality a great and useful piece of info. I am happy that you just shared this useful information with us. Please stay us up to date like this. Thank you for sharing.

Some really interesting details you have written.Assisted me a lot, just what I was searching for :D.

You have mentioned very interesting points! ps decent internet site.

Have you ever considered writing an e-book or guest authoring on other websites? I have a blog based upon on the same subjects you discuss and would love to have you share some stories/information. I know my audience would enjoy your work. If you’re even remotely interested, feel free to shoot me an email.

Hello my family member! I want to say that this article is amazing, great written and come with approximately all important infos. I would like to see extra posts like this .

Simply want to say your article is as surprising. The clarity on your post is simply great and that i could assume you’re a professional on this subject. Fine along with your permission let me to grasp your RSS feed to keep up to date with forthcoming post. Thank you 1,000,000 and please keep up the rewarding work.

certainly like your web site however you have to take a look at the spelling on several of your posts. Many of them are rife with spelling problems and I to find it very bothersome to inform the truth then again I’ll surely come back again.

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.

I’ve recently started a site, the info you provide on this website has helped me tremendously. Thanks for all of your time & work. “Men must be taught as if you taught them not, And things unknown proposed as things forgot.” by Alexander Pope.

Whats up very cool blog!! Man .. Beautiful .. Superb .. I’ll bookmark your web site and take the feeds additionallyKI am happy to search out numerous useful information right here in the submit, we want work out more techniques in this regard, thanks for sharing. . . . . .

Rattling nice pattern and wonderful content material, hardly anything else we need :D.

Outstanding post, I conceive people should larn a lot from this website its real user friendly.

Good day very nice website!! Man .. Beautiful .. Wonderful .. I’ll bookmark your blog and take the feeds additionally…I am glad to find so many useful info right here within the put up, we’d like develop extra techniques in this regard, thank you for sharing. . . . . .

Whats Happening i’m new to this, I stumbled upon this I’ve discovered It absolutely helpful and it has aided me out loads. I hope to contribute & assist other customers like its aided me. Great job.

Great post. I was checking constantly this weblog and I’m impressed! Extremely helpful information specially the ultimate phase 🙂 I take care of such info much. I used to be seeking this certain info for a long time. Thanks and best of luck.

I like this blog very much so much fantastic info .

Hello my friend! I want to say that this article is awesome, great written and come with almost all vital infos. I’d like to see extra posts like this.

There are some attention-grabbing time limits on this article but I don’t know if I see all of them center to heart. There is some validity however I will take hold opinion until I look into it further. Good article , thanks and we wish more! Added to FeedBurner as well

I savor, lead to I discovered exactly what I used to be taking a look for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

A formidable share, I simply given this onto a colleague who was doing a little evaluation on this. And he actually purchased me breakfast as a result of I found it for him.. smile. So let me reword that: Thnx for the deal with! But yeah Thnkx for spending the time to debate this, I feel strongly about it and love studying more on this topic. If potential, as you turn into experience, would you mind updating your weblog with more details? It is extremely helpful for me. Huge thumb up for this weblog publish!

You can certainly see your expertise within the paintings you write. The arena hopes for even more passionate writers such as you who aren’t afraid to say how they believe. All the time go after your heart. “If you feel yourself falling, let go and glide.” by Steffen Francisco.

I have been absent for a while, but now I remember why I used to love this blog. Thank you, I’ll try and check back more frequently. How frequently you update your site?

I would like to express appreciation to this writer just for bailing me out of such a predicament. Right after checking throughout the the net and obtaining strategies which are not productive, I figured my entire life was over. Living without the presence of solutions to the difficulties you’ve fixed through your main site is a serious case, and the kind which may have negatively affected my entire career if I had not noticed your website. Your expertise and kindness in maneuvering the whole lot was helpful. I don’t know what I would’ve done if I hadn’t discovered such a step like this. I can also now look forward to my future. Thanks a lot very much for your high quality and results-oriented help. I will not hesitate to propose your site to anybody who ought to have care on this issue.

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

obviously like your website however you need to take a look at the spelling on quite a few of your posts. A number of them are rife with spelling problems and I in finding it very troublesome to inform the reality then again I’ll surely come back again.

I think this web site holds some rattling fantastic information for everyone :D.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

Hey there, I think your blog might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, very good blog!

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thank you again

Hey there! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog post or vice-versa? My site covers a lot of the same topics as yours and I feel we could greatly benefit from each other. If you happen to be interested feel free to send me an email. I look forward to hearing from you! Wonderful blog by the way!

I absolutely love your blog and find almost all of your post’s to be just what I’m looking for. Do you offer guest writers to write content to suit your needs? I wouldn’t mind creating a post or elaborating on a few of the subjects you write in relation to here. Again, awesome site!

Hey very nice web site!! Guy .. Beautiful .. Wonderful .. I will bookmark your blog and take the feeds also?KI’m satisfied to seek out numerous helpful information right here within the post, we’d like work out more techniques on this regard, thanks for sharing. . . . . .

I am really enjoying the theme/design of your weblog. Do you ever run into any internet browser compatibility problems? A number of my blog audience have complained about my website not operating correctly in Explorer but looks great in Chrome. Do you have any ideas to help fix this issue?

I think other web site proprietors should take this site as an model, very clean and excellent user genial style and design, let alone the content. You’re an expert in this topic!