To get a business loan from the Development Bank of Nigeria, you must meet all the qualification criteria – You must have your business in Nigeria, have a functional account in any of the Participating Financial Institutions (PFIs), have a business plan and in most cases, an existing business.

Nigerians are creative, industrious and tenacious people. However, this fact does not stop many Nigerians from trooping out of the country at the slightest opportunity. This move is usually as a result of the lack of opportunities to thrive within the country (Nigeria).

With the present rate of unemployment in Nigeria, as reported by the Premium Times, The minister of labour and employment reported that Nigeria’s unemployment rate is projected to reach 33.5% by the end of 2020. The figures currently are – an unemployment rate of 23.1 per cent, and underemployment of 16.6 per cent as stated by the National Bureau Statistics (NBS) of 2019 report.

Starting up a business, therefore, seems to be the best option for many Nigerians. Several creatives within the country, have ideas they would love to develop by starting up an enterprise, the financial implication of starting a business always seems to be the issue.

While some Nigerians are lucky enough to have angel investors fund their ideas, others are not that lucky. These angel investors are rare. Hence, the option left for most people looking for business funding is that of taking a loan, another upheaval task in Nigeria.

However, business owners still talk about the several issues they face while trying to acquire loans from banks. The most severe complaint is usually the fact that there are only a few opportunities for businesses to receive credit from banks. When business owners eventually find opportunities to obtain loans from commercial banks, the terms and conditions are usually stringent.

Hence, this article was written to open the eyes of Nigerian business owners to another opportunity in this area.

Suggested: Solved: Top 6 Challenges of Small Business Owners Today

Most entrepreneurs go into business with a lot of hope and enthusiasm; but, these, with time, are often met by challenges that ultimately make or mar the business.

Have you ever heard of the Development Bank of Nigeria? This bank could be the best option for business owners trying to secure a loan. Before discussing how to get a business loan from the development bank of Nigeria, it is pertinent to understand what the bank is all about. The next sections of this article will explain more.

Contents

What is Development Bank of Nigeria?

Development Bank of Nigeria (DBN) is a bank owned by the federal government of Nigeria and assigned with the task of catering to the financial challenges faced by Micro, Small and Medium Scale Enterprises (MSMEs). DBN was launched on the 23rd of March, 2015.

According to the speech given by Ngozi Okonjo Iweala, the Minister of Finance at the time, the federal government created the institution to provide financial access to micro, small as well as medium enterprises. It was set up to give debt or equity (which cannot be given by the capital market and commercial banks) to these enterprises. These goals were in line with the purpose for which development banks are being set up worldwide.

Additionally, the bank was created with a bigger picture of industry diversification, income redistribution between social classes, as well as job creation. DBN has partnered with several global development bodies including World Bank (WB), African Development Bank (AfDB), French Agency for Development (FAD), and European Investment Bank (EIB).

The federal government launched the DBN to see to it that Nigerians put their creativity to full use. While youths have complained (time after time) about the unemployment rate and the lack of opportunities, the Federal Government listened to these pleas by creating this avenue for creativity. The plan was to allow financial inclusion for youths and older adults who have limited opportunities in terms of converting their dreams to reality.

Basically, “you got a dream—get it across to DBN”.

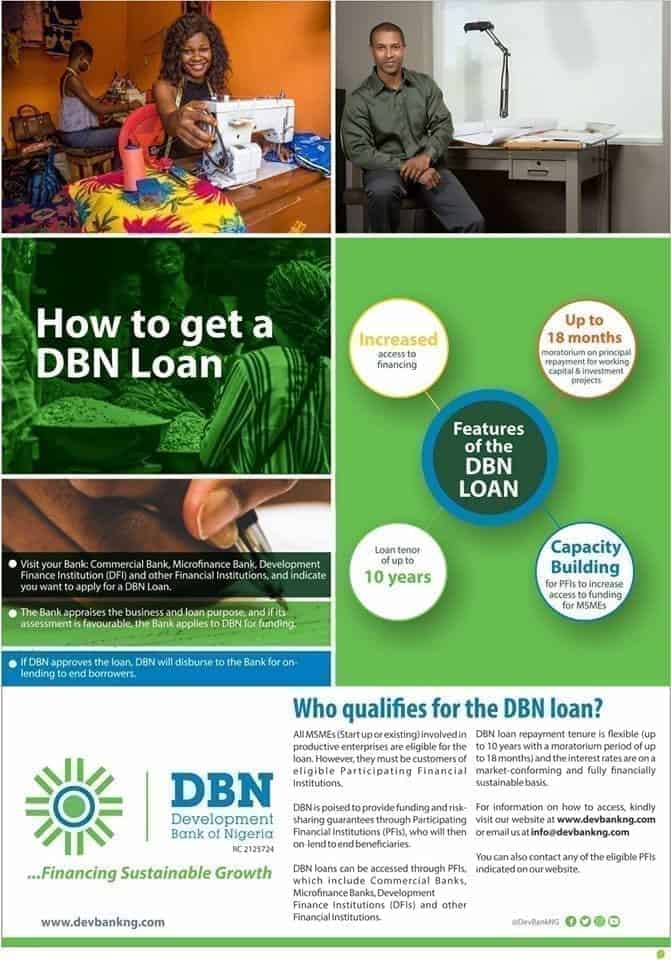

The loan repayment plan of the DBN is quite flexible. The tenure lasts up to 10 years, coupled with a period of a moratorium of up to 18 months. Also, the interest rates are on a fully sustainable and market-conforming basis. Hence, this makes taking a loan from DBN about the best loan-taking option for Nigerian entrepreneurs.

What is the Role of Development Bank of Nigeria?

Development Bank of Nigeria exists to alleviate financing constraints faced by

Micro, Small and Medium Scale Enterprises (MSMEs) in Nigeria.

DBN

The federal government primarily set up DBN to help in the growth of small startups. Thus, the bank gives financing, as well as partial credit guarantees to all eligible financial intermediaries.

This act reduces the financial obstacles that hinder the growth of commerce and domestic production. This way, the financial gaps experienced by startups become almost non-existent.

In simpler terms, the bank provides loans that allow startups to thrive while reducing the burden of their financial obligations.

Who is Eligible for these loans?

All micro, small, and medium enterprises (MSMEs) involved in running productive ventures qualify to get a loan from DBN. This simply means that as long as the Nigerian is an entrepreneur, an individual that owns a startup company or a businessman (or woman), they qualify to get a loan.

Easy, right?

However, they have to be customers of one of the participating financial institutions (PFIs). This criterion is vital since DBN passes funds through the PFIs, as opposed to giving the loans directly to businesses or business owners.

The Participating Financial Institutions (PFIs) serve as the middlemen in the transaction between DBN and startups. They are responsible for the credit evaluation and supervision of the loan.

Here’s a list of the PFIs:

- Major Commercial Banks

- Development Financial Institutions

- Microfinance Banks

- Other financial institutions

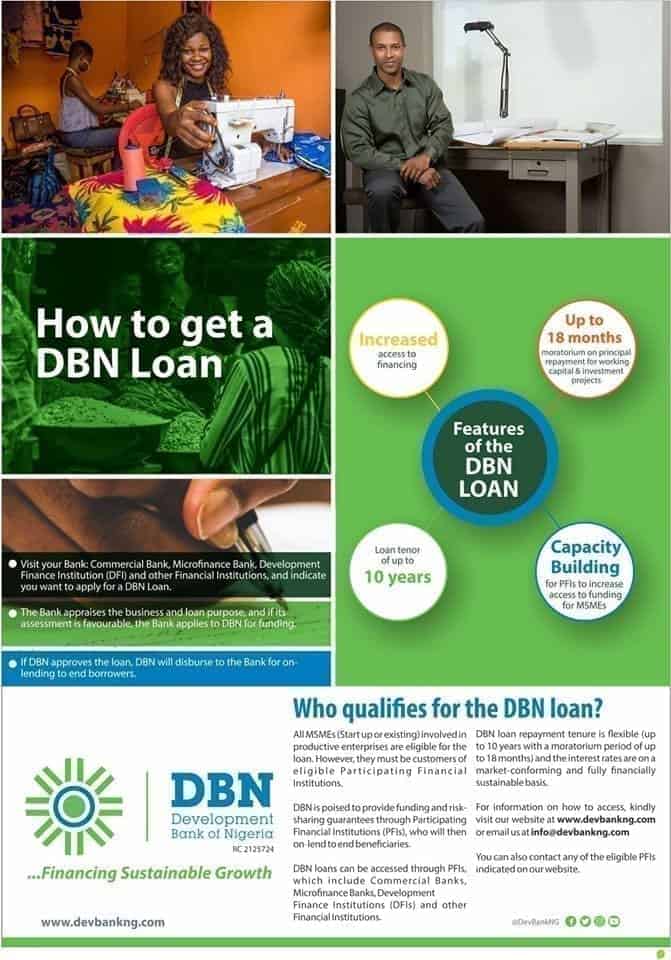

How to Obtain a Business Loan from DBN

Now, to the crux of the matter. Here are the steps to take as a business owner looking to take up a loan from the DBN.

Step one: Pay a visit to the bank

The bank in question must be a major commercial bank, development financial institution, microfinance bank or other financial institution (basically a PFI). At the bank, the business owner needs to indicate their need to apply for a DBN loan.

Step two: Assessment

There is a phase of assessment. During this phase, the bank looks through the business and the reason for which the entrepreneur needs the loan. This act is basically to judge if all factors within the business suit the need to take up a loan. If the business owner’s bank is satisfied following their assessment, then they would go on to apply to DBN on behalf of the business owner.

Step three: Approval

Here, DBN looks through the request of the bank. If DBN approves this request, the institution will release the loan to the bank. Thus, the bank will release the loan to the business owner.

Some Frequently Asked Questions About The DBN (FAQ)

Summary

Here’s What Entrepreneurs looking to get a DBN Loan Need to Take Away from this article:

- DBN was created by the Federal Government of Nigeria to help small businesses thrive.

- DBN never lends directly to members of the public. Individuals would always have to go through the PFIs to access loans.

- DBN offers very flexible payment plans. Additionally, there’s an 18-month period of rest before businesses need to begin loan repayment, which lasts for up to 10 years.

- The pricing of the loan is highly realistic, with market rates being considered.

- To get a loan, entrepreneurs have to visit their bank and make a request. Following their application, there would be an appraisal.

- If the business scales through the appraisal, the bank applies to DBN on behalf of the business. If this application is approved, through the bank, DBN provides the funds for the individual.

- Only 29 financial institutions currently have access to the whole process. Business owners need to confirm if their bank is a PFI.

Conclusion

The process of getting a DBN loan is straight forward. However, a significant percentage of the business owners have hardly heard a thing about this fantastic opportunity. With this information at the fingertips of any Nigerian business owner or startup with great ideas, the sky is only the starting point.

Click here to get a full list of Participating Financial Institutions and their contact persons.

Congratulations!

boston casino

References:

freeshuswap.com

perth casino

References:

gatradewata.com