If you struggle with bookkeeping and accounting, you are not alone. Bookkeeping and accounting is a major challenge for a lot of people especially those with zero accounting background.

Do these questions ring any bell?

What records should I track?

How do I sort my business and income tax?

What bookkeeping method should I use?

Then keep reading.

Let’s talk about bookkeeping.

Contents

What is Bookkeeping?

Book keeping is the process of recording and organizing your financial transaction.

Note that Bookkeeping goes beyond recording financial transactions.

Your financial record needs to be organized. And it takes a process.

You can choose to simplify the process but you cannot completely eliminate it.

A small sheet of paper starched carelessly on a shelf isn’t a proper financial record. Your monthly bank statement is not a sufficient excuse for your financial record because, it does not contain all financial transactions.

Every penny spent on your business has to be tracked. Even the money you received as gifts.

Here’s why. For Tax purposes and to measure profit.

Whatever trade you do, business requires money. As a small business owner, you need to understand what is happening with your money in other to make the right financial choices.

And,

Now this is goes beyond small businesses to include freelancers and other independent service providers.

As a business owner or freelancer in Nigeria you need to stay steps ahead of the unstable political atmosphere.

SEE ARTICLE ON: Buhari’s new policy on companies and allied matters bill and its effect on small businesses

So what aspects of your business’s financial transactions should you track? Every aspect.

You might know a bit of keeping track of financial record but what about organising your financial records.

Without organizing financial transactions, the entire accounting process becomes tedious.

It’s cool to have a fancy app that allows you to keep accounting records. But how sure are you that you’ve taken proper records.

FIRST THINGS FIRST: Open a business account.

It’s important to separate personal account from business account even if all you do is sell human hair on Instagram. One day, the FIRS will come knocking and only a well-articulated financial record will save you.

Now, Bookkeeping may be tedious but it’s a necessary evil. In fact, you are legally required to keep financial records.

As much as I disliked Accounting courses, I have highlighted a detailed breakdown to help your business meet its accounting and bookkeeping needs.

TRACKING EXPENSES

What expenses to track. This is relative to business types, but I’ll try to bring everyone along. Regardless of your business need, here’s what you need to know: each account falls under the following account type;

- Asset: Your assets account records all that your business own; cost of properties and equipment and even cash at hand.

- Liability: This account reflects all form of debts owed by the company, mortgage, credits and loans.

- Expense: Expense accounts records all the money spent from the business on purchase, payroll, rent and even advertising.

- Revenue: This account is also regarded as your income account; it holds record for every money that comes into the business through sales or interest.

- Equity

Thanks to technology, a single accounting app can hold all your accounting and bookkeeping records.

Types of Bookkeeping

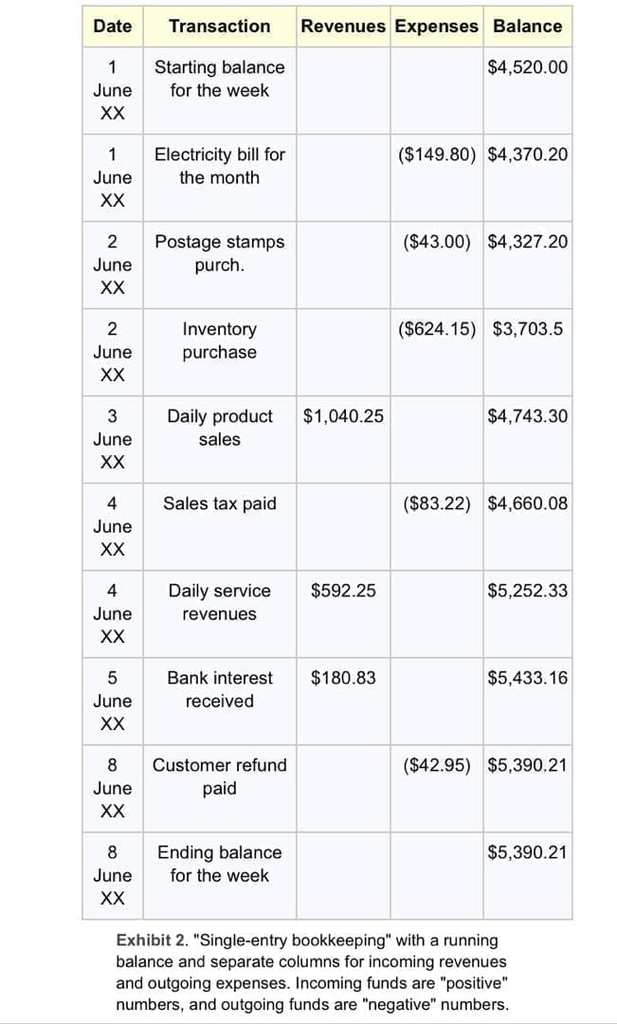

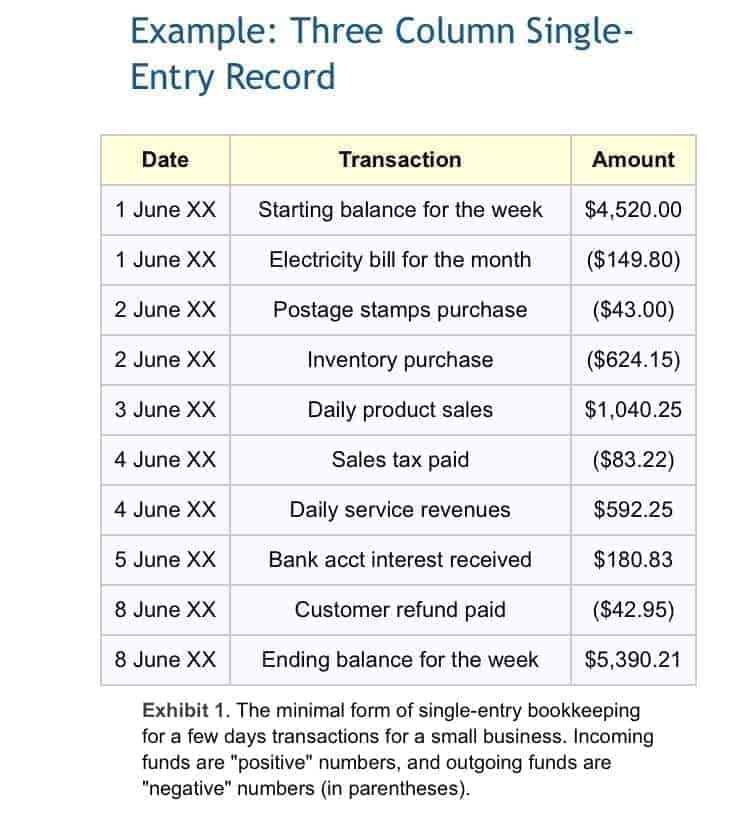

There are two types of book keeping. The single entry and the double entry bookkeeping.

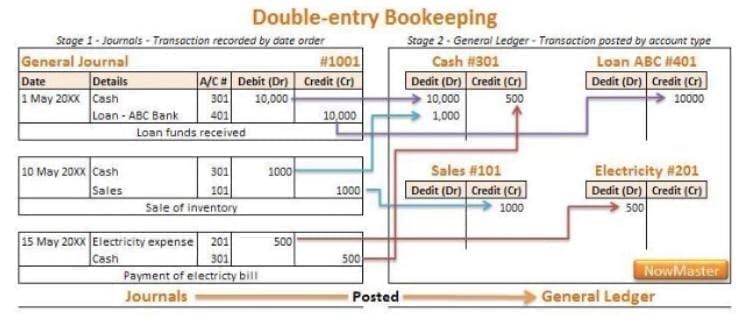

Don’t let the word ledger scare you. It’s a journal that records expenses. You know how small business owners have one general book where they write every business transaction. That’s a general ledger. It holds all records of your debits and credits. At the end of each day, the ledger balance shows the basic accounting activity of the day.

Now not all expenses debited from your account actually leaves your business. For example, when you spend money on an equipment your cash account reduces but your asset increases. In that way, you’re making expenses but your business is growing. Which is why you need different accounts for the varying need of your business.

This is where the double entry bookkeeping becomes effective.

Notice the difference in the picture above and this one? With double-entry bookkeeping, Credits and debits are calculated in separate columns.

The double ledger is a more detailed accounting system. If your bookkeeping becomes overwhelming, it’s time to consult an expert.

TRACKING ACCOUNTING RECORDS

Do it when your mind is engaged. Numbers can numb your mind, so the only way is to deal with it when your mind is engaged. Obviously! Trust me you’d know when you need and Expert. As your business needs increases you’d need more than a few basics in accounting and bookkeeping. But getting involved with your business account from the scratch ensures you don’t get swindled along the way.

Create a schedule and stick to it. Numbers are overwhelming when they appear in large sums. Which is why you shouldn’t put off today’s accounting task for tomorrow. Create a schedule at the close of day to balance your books. If something doesn’t add up, you can sleep and refresh and give it another look. For freelancers and other small business owners with irregular hours and income. Commit to reviewing your account statements whenever you find a free time in your schedule.

Balance your books. Make sure you enter the write transaction under the right account by asking a few questions.

What is this money doing for me?

If it’s leaving your account, where is it going? What did you spend it on? Questions like this would help you navigate the different types of account and maintain proper accounting record. Wrong entries may result in disparity in your debits and credits.

Prepare financial reports. No need to fret if you’re the smaller your business the less tedious your financial report. You just need to know the basics when it comes to preparing a financial report.

There are four main document’s required when analysing your business income for any financial year.

1. Balance sheet

2. income statements

3. Cash flow Statement

4. Shareholder’s equity

SEE this article on a step by step guide to writing a detailed financial report.

TAX REPORTING

Know your tax obligations. You cannot avoid tax. Like most small business owners, your aim is to keep tax bills very low. To do this you need to know the Tax allowances allowed for your business.

For example, Self-employed persons pay tax from their business profits not their earnings. Ignorance is not an excuse. For questions on tax calculations, consult an expert.

Great site to read. Many US College Students are needing more assistance with their class assignments than ever before. Essays Unlimited can assist with this issue.